If Steve Wynn builds it, will they come?

Yesterday marked the opening of the $4.1B Wynn Palace in Macau. The grandiose property will feature 1,700 rooms, a floral theme, an artwork collection worth upwards of $125M, and 200k square feet of retail space. The new resort is obviously tailored to Chinese VIP gamblers who aren’t necessarily feeling the effects of China’s economic slowdown.

“Macau is clearly operating in an environment of increasing costs and mounting competition amid a challenging macro environment,” Daiwa Capital Markets analyst Jamie Soo said last week in a research note to clients. “We view the Street’s forecasts for incremental profitability due to new property openings this year to be far too optimistic.” (via CNBC)

George Choi of Citi, see’s a more positive outlook for Wynn’s Macau property: “We believe Wynn Palace is a potential game-changer for Wynn and will increase Wynn’s hotel room count by 168 percent, from 1,010 to 2,710,” Citi analyst George Choi said in a note. “We like the earnings improvement that the new Macau property will likely bring to Wynn.”

It’s common knowledge that Macau is a revenue machine for gaming companies:

| Metric | Macau | Las Vegas |

|---|---|---|

| Slot machine win per unit/day | $710 | $289 |

| Table game win per unit/day | $11,092 | $5,792 |

DATA SOURCE: WYNN RESORTS FIRST-QUARTER 2015 EARNINGS REPORT.

The true test is if it is maintainable (let alone scaleable) in an economic slowdown and ever-changing government regulations.

Will Wynn Palace help or hurt $WYNN?

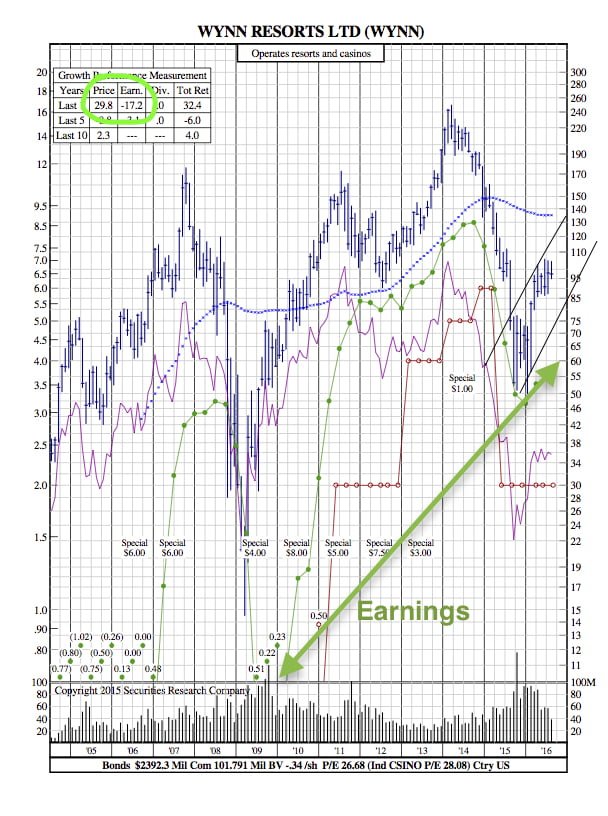

Looking at SRC’s 12-Year Chart for Wynn –

We see that the past couple years has shown that a strong correlation exists between earnings (largely due to exposure) and Macau data and news. Now, with Wynn’s latest investment, the hope for investors is a narrowing of the price/earnings gap seen in the chart above – ideally by way of increased earnings.