Zillow Releases $400M in Convertible Debt (12-Year Chart Inside)

Zillow (Z, ZG) has released $400 million in convertible senior notes. The company will use the proceeds of the debt for general operations and to refinance a previous debt that its subsidiary, Trulia, took out for general purposes. The new debts will be due 2021.

The real estate search company opened down nearly 1% from yesterday’s close. The Nasdaq 100 opened up slightly, with the PowerShares QQQ Trust (QQQ) up nearly 0.3% at the opening bell.

Zillow has a history of fueling growth with debt. The company’s total debt level of $230 million was 9% of shareholder’s equity at the end of the third quarter of 2016. At the same time, net cash flow from operations was $30 million, meaning it would take nearly two years to earn enough cash to pay off its current debt and over five years to pay its new loans.

Despite the relatively weak cash flow, Zillow’s recent operations have gone from resulting in a net loss to a small profit. That is thanks to a 27% year-over-year increase in revenues, which have helped the firm’s operating income rise from a $27.7 million loss in the third quarter of 2015 to a $7.8 million gain in the third quarter of 2016. That represented Zillow’s first quarterly profit since the fourth quarter of 2013.

The market largely anticipated the strong third quarter results, which Zillow’s management reported on Nov. 1. Zillow shares rose 40.6% year-to-date before that release and have risen 1.8% since then.

The convertible notes could increase the company’s total outstanding shares, which have risen 32% year over year.

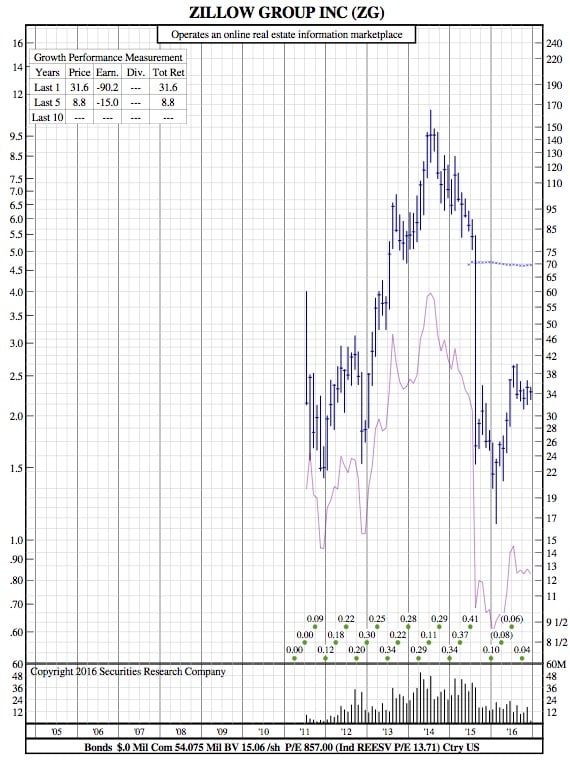

ZG 12-Year Chart: