Will the Dow hit 20,000 within the next year?

In 1999, the Dow Jones Industrial Average hit a record 10,000. Now, 17 years later, it’s time to consider when that 1999 record is going to be doubled. But before we do that, it’s important to note what the Dow is and how it’s weighted.

The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue chip stocks. A price-weighted index is a stock index in which each stock influences the index in proportion to its price per share. The value of the index is generated by adding the prices of each of the stocks in the index and dividing them by the total number of stocks. Stocks with a higher price will be given more weight and, therefore, will have a greater influence over the performance of the index. (Investopedia.com)

In short, for the Dow to reach 20k, the 30 stocks that make up the index must continue to rise in price.

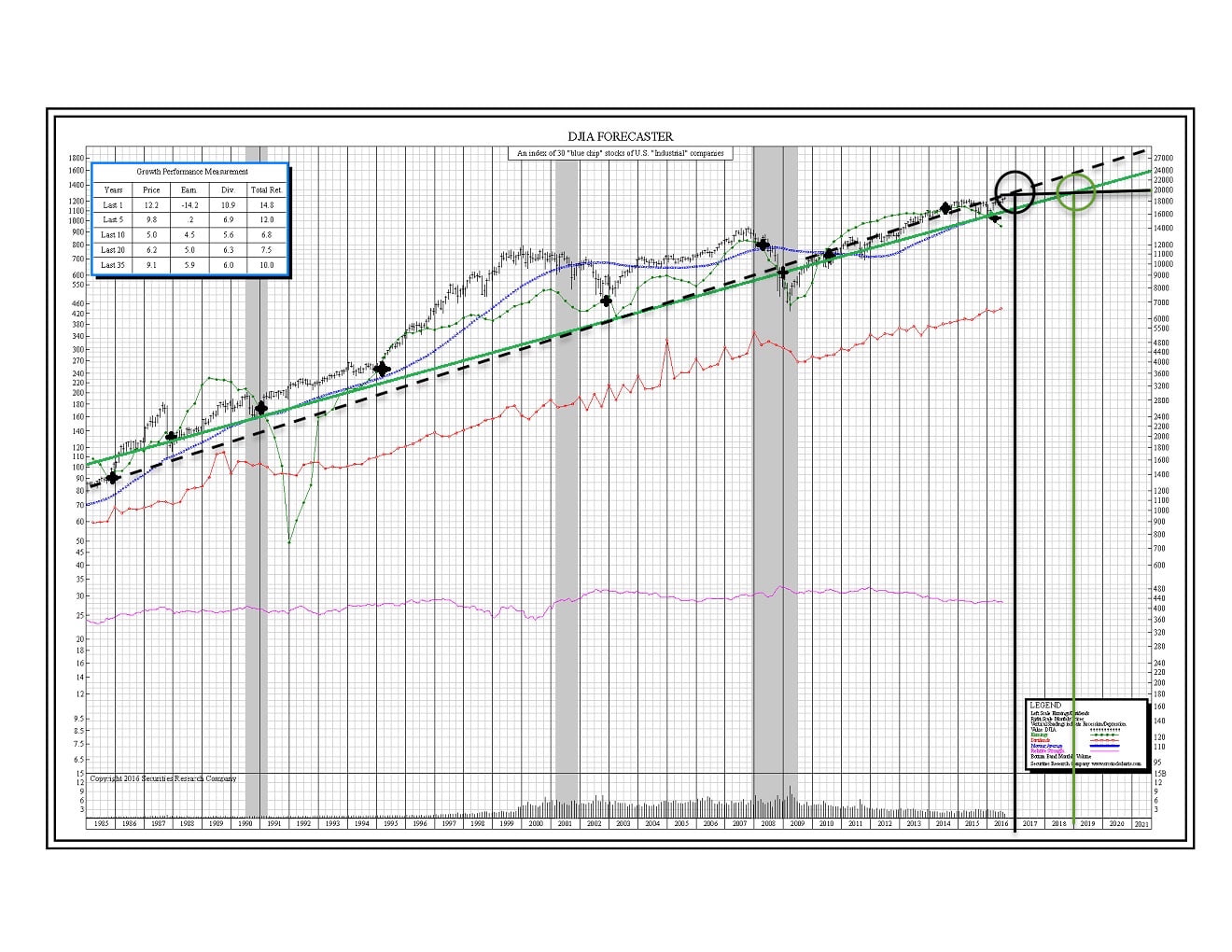

When we look at SRC’s DJIA Forecaster (see below), we see that a conservative approach (based on earnings) indicates that the Dow will hit 20k around January 2019 – it’s important to note that when reading the chart; when price and earnings intersect, the PE ratio is read as 15:1.

A more aggressive approach forecasts price to hit 20k within the year.

It’s something that’s “really not that extreme of an outcome,” said Daniel Skelly, head of equity model portfolio solutions at Morgan Stanley Wealth Management. He said during an interview on CNBC’s “Power Lunch” that the index could hit that level depending on “classic fundamental drivers” like earnings and GDP growth.

Either way, getting to 20,000 is going to be bumpy, not linear – and that may trigger alarms (which obviously prolongs the target). Having the Dow reach 20,000 will depend on several factors, including earnings and monetary policy.