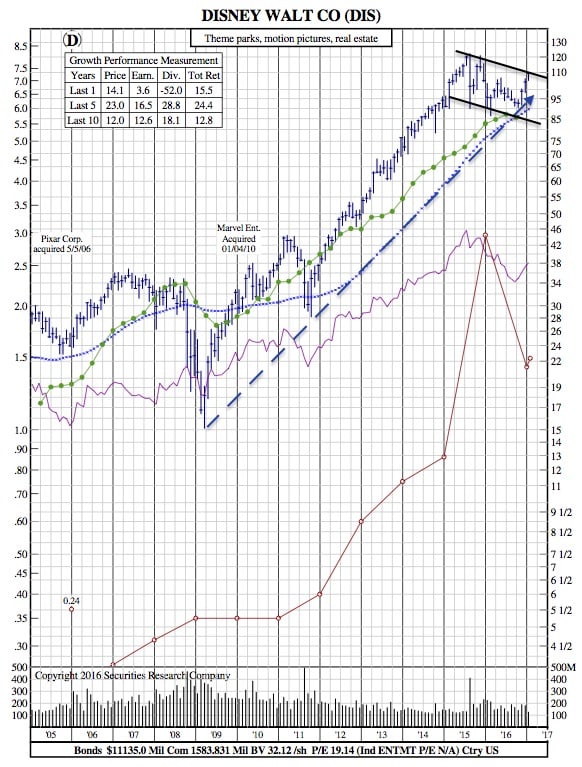

Will New Streaming Options Allow ESPN to Contribute to Disney’s Bottom Line like it Once Did? (Disney 12-Year Chart)

Barron’s — There’s a lot more life in ESPN than Wall Street seems to think. Some big investors have gone so far as to question whether Disney should part ways with the giant sports network.

ESPN has always been very profitable for parent Disney and very expensive for distributors like Comcast to carry. But with TV viewing habits changing, the concern is that Disney could lose its profit engine. The growing availability of “skinny bundles” and over-the-top streaming services means subscribers are no longer forced pay for ESPN if they don’t want all those sports.

“We believe the combination of moderating skinny bundle headwinds and the emergence of new, low-priced streaming options create opportunities for incremental ESPN distribution,” Swinburne wrote in a research report Monday.

He upgraded Disney shares to “Overweight,” the equivalent of a buy rating and thinks they can hit $124, 12% higher than current levels. The stock was up 1.5% on Monday.

Disney will begin to negotiate new agreements with cable companies in 2018, and Swinburne thinks the company has more pricing power than Wall Street realizes.

And with more streaming services still to come, that could be more opportunity for ESPN to pick up new subscribers. “We also believe new entrants (such as Hulu Live or YouTube Unplugged) will pay premium affiliate fees,” he wrote.

On top of all that, Swinburne thinks Disney’s slate of fiscal 2018 movies will be a plus.

Disney 12-Year Chart: