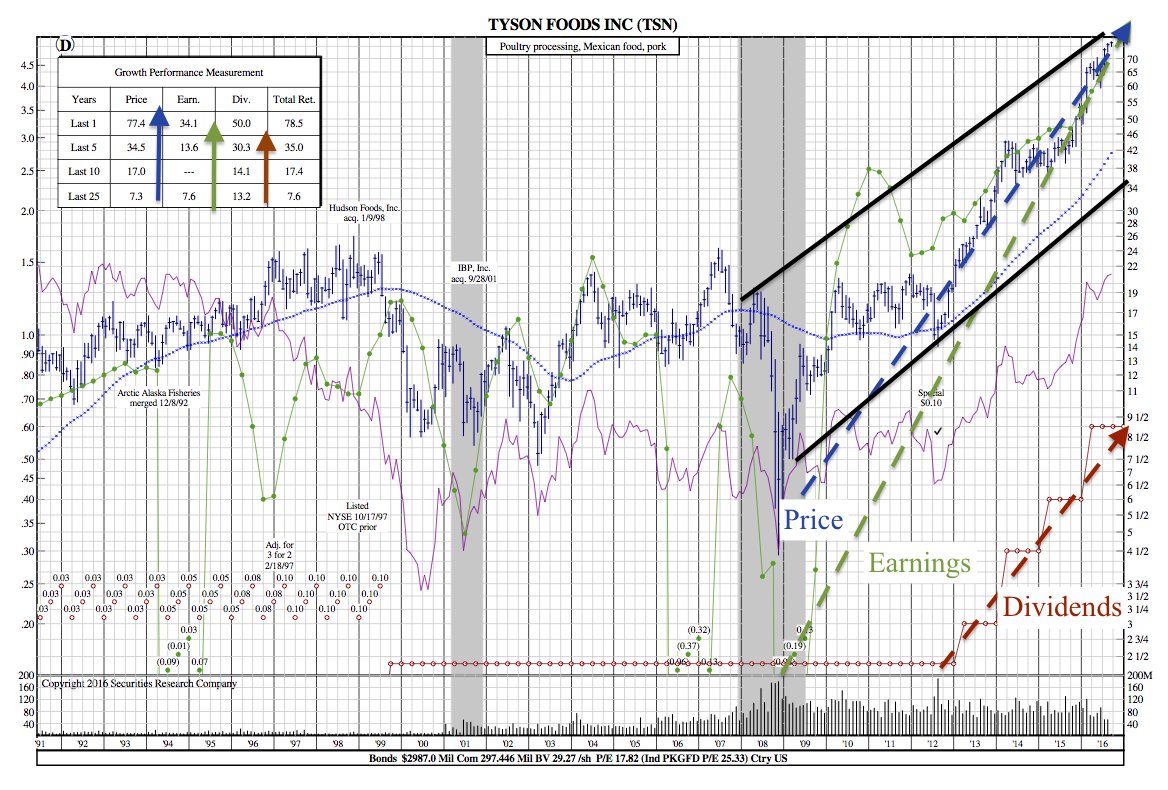

Tyson Foods 25-Year Chart Shows Impressive Growth Among 3 Major Indicators

Since 2009, Tyson Foods ($TSN) has been on a great run. Among other consumer staple stocks, Tyson is a great option for strong returns in your portfolio. This year alone, $TSN has seen its price rise nearly 43% and has a potential earnings growth rate of 43% for the fiscal year.

What’s driving the strong performance?

Tyson is continuously innovating and adding new products to its already rich portfolio as it is an integral part of their growth strategy. In Jul 2016, the company launched Jimmy Dean stuffed hash browns and Ball Park frozen sandwich meats that include pulled pork, meatballs and steakhouse burgers. This has been well received by consumers. Additionally, the company intends to introduce an extension of the Hillshire Snacking platform and new Tyson Naturals line of frozen chicken products made of all-natural ingredients and with no antibiotics, in Sep 2017. (Yahoo Finance)

In August, consumer confidence surged to record level, highest in the past 11 months. Lower gas prices, rising consumer confidence and higher than expected job data in Aug 2016 has positively impacted the consumer staples sector.

Looking at SRC’s 25-Year Chart, we see strong growth in price and earnings. Accordingly, Tyson has rewarded investors with dividend increases (30% average increase over the past 5 years).