Two Companies with Earnings this Week and Their 21-Month Charts

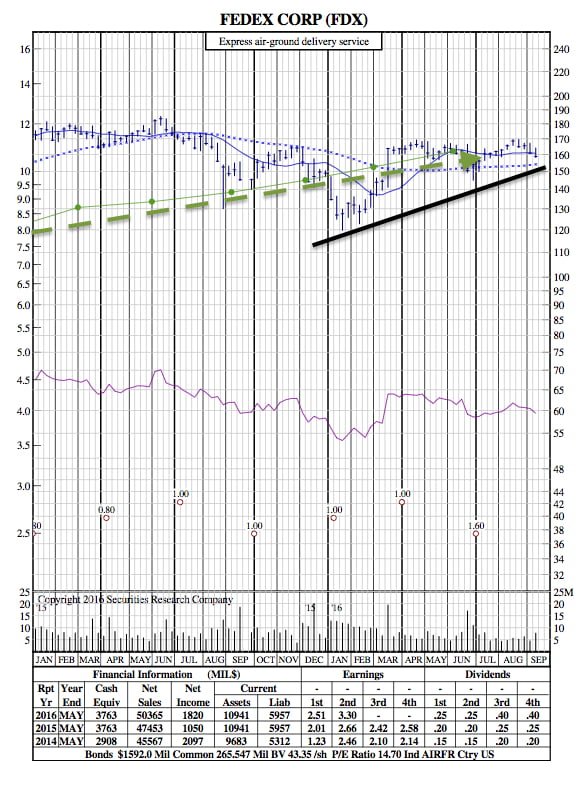

1. Fedex ($FDX) – Tuesday, Sep. 20 at 4:15pm ET – 2.78 EPS Estimate

UBS analyst Thomas Wadewitz and team contend FedEx has a “favorable set-up” heading into earnings report on Sept. 20. They explain why:

Our analysis indicates that the macro environment for FedEx was likely stable in 1QF17 for FedEx and similar to the environment in 4QF16. This is based on looking at the ISM PMI on average during 1Q and 4Q and also looking atIP Manufacturing and Retail Sales y/y. Jet fuel prices have been stable sequentially in 1Q vs 4Q (at ~$1.55/gal including taxes / loading charges) and in line with our forecast. While we don’t have clear visibility we believe there is room for upside relative to Consensus of $2.78/share and we are maintaining our estimate of $2.86/share.

They also think FedEx is cheap:

Valuation: attractive valuation amid a paucity of cheap stocks. FedEx is trading at a blended one year forward P/E of about 13x on our EPS estimates. We believe that FedEx’s current P/E valuation is notably attractive at 13x compared to its 10 year average forward P/E of 14.9x especially in an environment where it is difficult to find transports at a low teens P/E or cheap vs their historical average. Our price target of $187 is based on applying a P/E of 14.5x to our CY2017E EPS of $12.87/share.

Source: Barrons

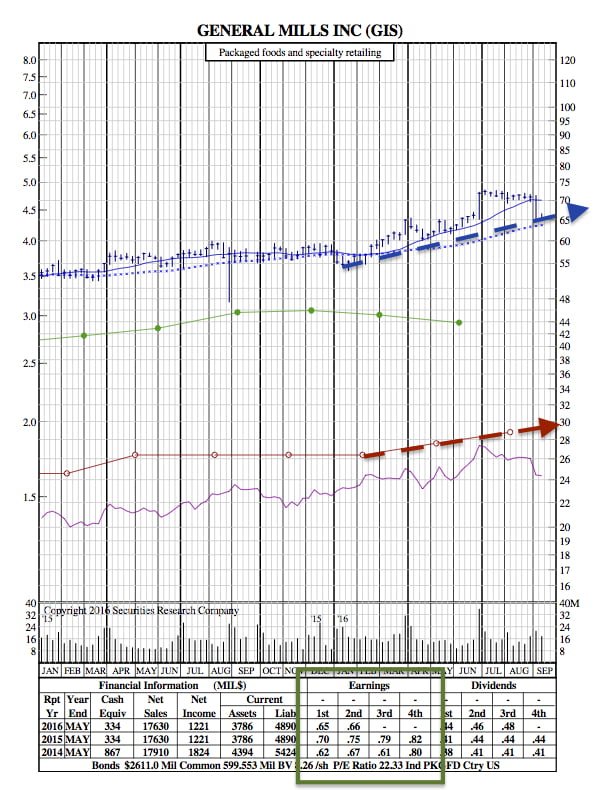

2. General Mills ($GIS) – Wednesday, Sep. 21 before market open – 0.75 EPS Estimate

Deutsche Bank, which has a Hold rating on General Mills, expects operating EPS of $0.75 versus $0.76 consensus. The brokerage projects sales to fall 6.8 percent sales to $3.92 billion.The company recently indicated its first-quarter organic sales would be below full-year guidance (down 0-2 percent) while EPS would be down versus year-ago levels ($0.79). (Yahoo Finance)