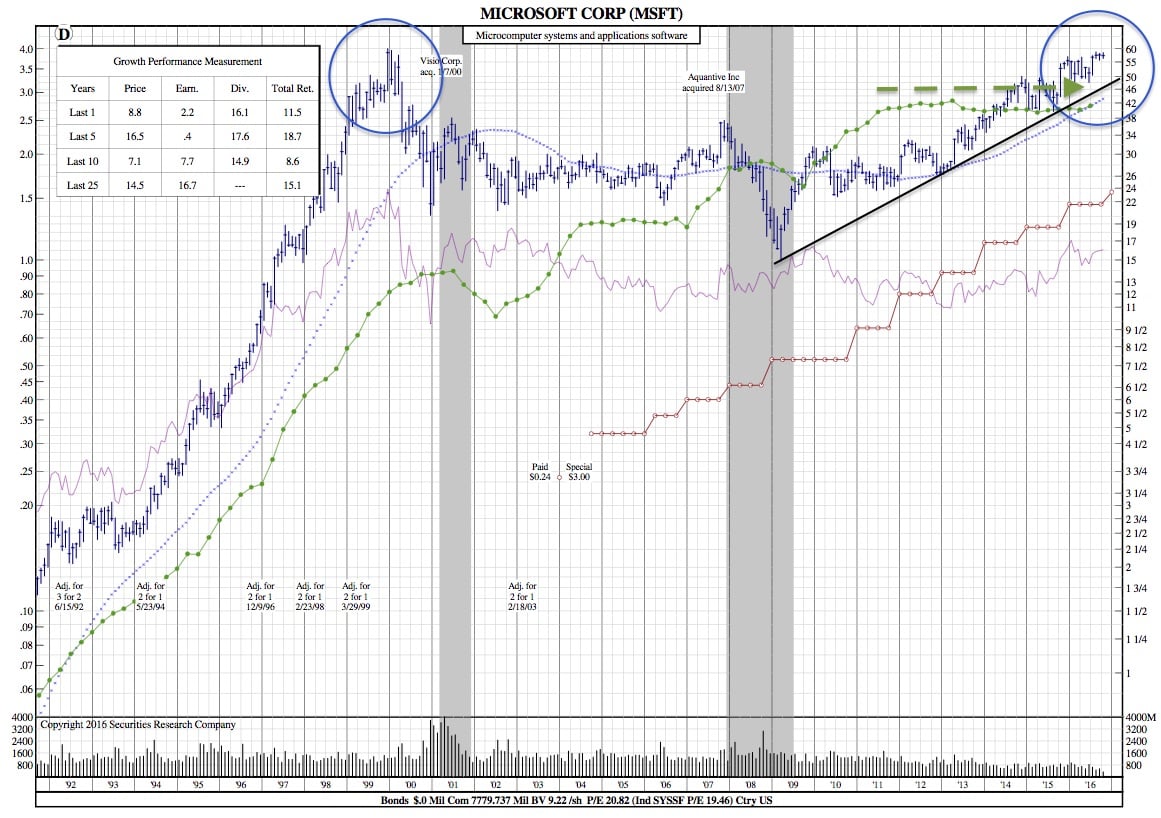

Microsoft Surpasses its All Time High – A Record That’s Stood for 17 Years (25-Year Chart Included)

Article: Business Insider–

Microsoft shares popped up to an all-time high of above $60 on Thursday as strength in its cloud business helped propel it past Wall Street financial targets in its fiscal first quarter.

Microsoft shares popped up to an all-time high of above $60 on Thursday as strength in its cloud business helped propel it past Wall Street financial targets in its fiscal first quarter.

It’s the first time Microsoft has set an all-time high record since December 1999.

The PC industry that Microsoft dominated back then is now in decline, but Microsoft’s strong performance during the quarter raised hopes that efforts to cultivate new, equally lucrative businesses are bearing fruit.

For the quarter, Microsoft reported (press release here):

- Earnings of $0.76 on an adjusted basis. Analysts were expecting $0.68 per share.

- Revenue of $22.3 billion on an adjusted basis, 2.3% higher than the same period in 2015. Analysts were expecting $21.71 billion.

Microsoft stock was up over 5% on the solid beat on the top and bottom lines in after-hours trading.

Investors are looking for signs of continued growth in Microsoft’s all-important cloud computing businesses, as it shifts away from selling boxed software and into a subscription- and usage-based billing model.

And they got it: Revenue in Intelligent Cloud, the business unit that encompasses Microsoft’s Azure cloud computing service and the rest of the company’s tools for servers and data centers, is up 8% to $6.4 billion. Azure revenue, in particular, grew 116% from the same period in 2015, Microsoft says, though it doesn’t disclose specific financials for that business.

Revenue in the Productivity segment was up 6% to $6.7 billion, driven in large part by the Office 365 subscription cloud productivity service among both consumers and businesses. The Dynamics software business was also a major contributor, up 11% from the same period in 2015.

It wasn’t all good news, though: Microsoft’s More Personal Computing segment, which includes Windows, saw its revenue go down 2% to $9.3 billion. While Microsoft says that Windows licensing was flat from the same period in 2015, slightly ahead of the overall decline in the PC market, revenue in its struggling phone business was down 72%, and revenue in Xbox was down 5%.

25-Year Chart:

Other than the historic price achievement noted in the right circle, Microsoft’s 25-Year Chart has been pretty consistent over 4-5 years. Dividends and Price have both grown at a stable 17%. The one concern is the lack of earnings movement. Over the last 5 years, earnings growth has averaged less than 1% and this year it’s around 2%.