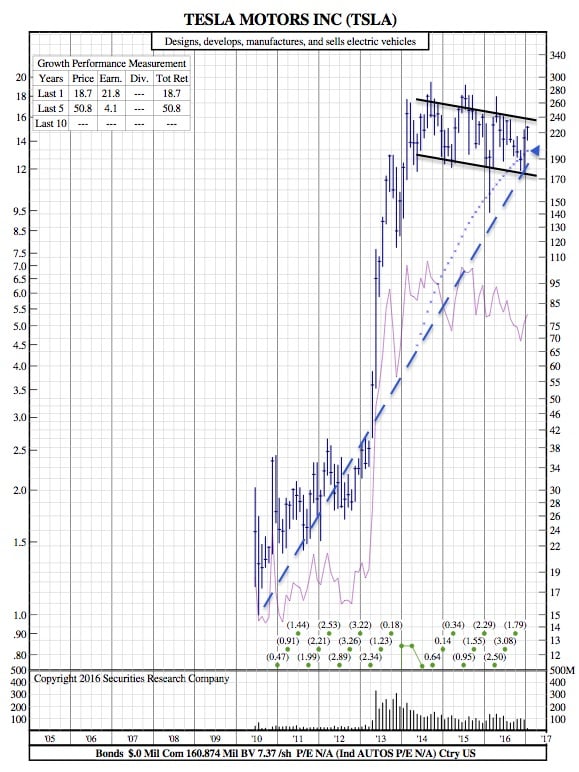

Looking at Tesla’s 12-Year Chart, 2017 May Prove to be Rather Bleak

The Street — Shares of Tesla Motors ( TSLA) jumped more than 5% on Wednesday after the company unveiled progress at its Gigafactory facility, causing some bulls to do a victory lap in their ongoing battle against shorts. A number of analysts remain skeptical.

Barclays analyst Brian A. Johnson, who has an “underweight” rating on Tesla shares, earlier this week published a note with tongue-in-cheek predictions of future Elon Musk tweets, laying out a list of potential concerns for the company. Musk, Tesla’s CEO, frequently uses Twitter to communicate with the company’s investors and customers.

Johnson predicts that in the months to come Musk will admit that the automaker’s forthcoming Model 3 will not arrive as promised in 2017, as well as a decision to “derisk with a capital raise.” Tesla has continued to insist that the more affordable Model 3 will be available this year, despite growing skepticism from analysts, and Musk said late last year that the company’s current financial plan “does not require” any immediate capital raise.

But Johnson said that “it’s tough for us to look past Tesla’s track record of cash burn,” predicting a $1.5 billion equity raise in the current quarter. He predicts no Model 3s will be delivered in 2017 and expects only 75,000 deliveries in all of 2018, well below Tesla’s guidance that total 2018 vehicle deliveries will jump dramatically to 500,000 from 76,230 in 2016.

The analyst also predicts Musk will scale back growth expectations at recently-acquired SolarCity, perhaps blaming a harsh regulatory environment, and lobby to President-elect Trump for electric vehicle subsidies perhaps by noting that Tesla is the only automaker with effectively all of its manufacturing in the United States.

Trump on the campaign trail and since the election has criticized both General Motors ( GM) and Ford Motor ( F) for their Mexican operations.

Tesla shares were surprisingly strong on Wednesday despite reporting fourth quarter and full-year deliveries that fell short of expectations. A well-timed tour of its Gigafactory facility where Tesla announced the start of mass production of batteries was likely responsible for much of the shareholder enthusiasm, with the company predicting that by 2018 the facility, which is about one-third complete, will double the world’s production of lithium-ion batteries.

A central plank of the bull case for Tesla is a belief that the in-house manufacturing of batteries will help lower the automaker’s overall component cost and allow it to bring the Model 3 to market at or near its $35,000 base price.

But UBS analyst Colin Langan, who rates Tesla as a “sell,” in a note said that “while the scale & automation were impressive, the event didn’t address the concerns” underlying his rating. He remains worried about Tesla’s ability to hit vehicle production targets, the company’s cash burn, its aggressive energy storage sales targets, and the Model 3’s profitability at launch.

Both Langan and Johnson are neutral on the impact of the incoming administration on Tesla. While some bears have predicted that Trump’s focus on fossil fuels over renewables could mean an end to subsidies for electric vehicles and solar panels, Musk has argued that the incoming president could surprise with a focus on alternative energy.

Johnson notes that with Musk included in the president-elect’s Strategic and Policy Forum, he is well-positioned to lobby the incoming administration and talk up Tesla’s status as a U.S.-based manufacturer. However, being in the room is no guarantee of preferential treatment: GM’s Mary Barra is among the initial appointees to the forum, but that status did not stop Trump from criticizing the automaker’s Mexican operations earlier this week.

Tesla 12-Year Chart: