JPMorgan 3Q Revenue Rises – Beats Estimates (12-Year Chart Included)

JPMorgan Chase ($JPM) reported $1.58 in diluted earnings per share for the third quarter.

JPMorgan managed to grow both loans and deposits during the quarter. Average core loans expanded by an impressive 15% during the year, driven by double-digit expansion of both consumer (excluding credit card) and commercial loan balances. Within the U.S., most deposit growth took place in interest-bearing accounts, and both the net yield on interest-earning assets and net interest margin remained flat.

The company’s investment bank is occasionally a volatile performer, but this quarter the company benefited from exceptionally good results. The company was again the top generator of investment banking fees among its peers. Rates, credit, and securitized product trading led to a 48% year-over-year increase in fixed-income market revenue. Expenses within the investment bank fell 20% at the same time, as the company experienced a big decline in legal costs compared with the third quarter of 2015. (Morning Star)

Overall, noninterest expenses fell by 6% over the last 12 months, mostly due to the aforementioned decline in legal expenses. However, occupancy expenses also fell by 7%. Though occupancy accounts for only 6% of expenses, we think the company’s scale should allow it to benefit as digital banking takes share from traditional branches.

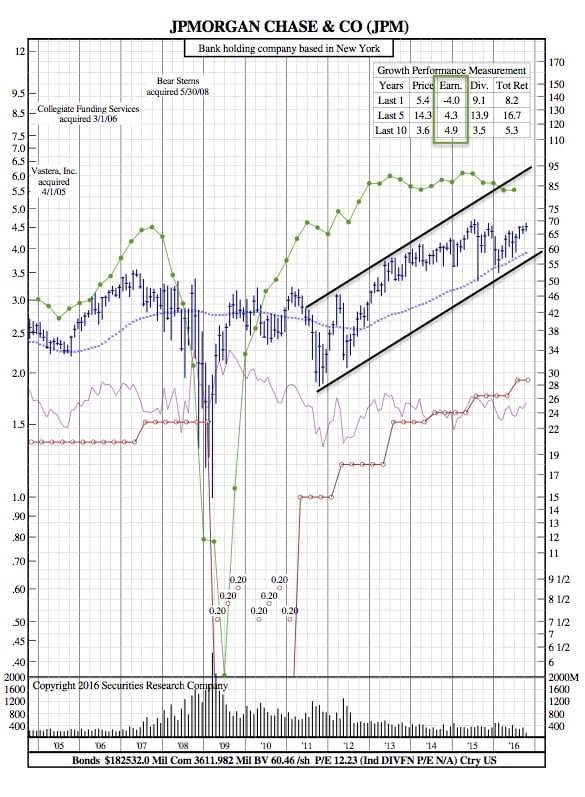

12-Year Chart:

Over the last year, JPM has had a total return of 8.2%, down from 16.7% over the past 5 years. Dividend growth looks to remain both constant and strong after this latest earnings report.

It’s also worth noting that price is currently lower than earnings (on a 15:1 scale) and may indicate a bullish outlook for price in the near future.