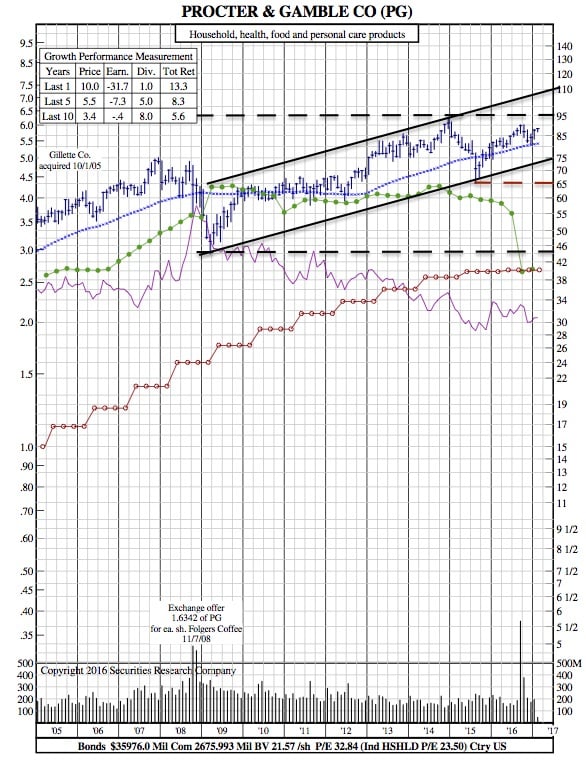

Is Procter & Gamble an Unreliable Investment? (12-Year Chart Included)

The Street — Procter & Gamble (PG) is a funny kind of corporate titan. It has been a component of the Dow Jones Industrial Average since 1931. Yet its stock contributed virtually nothing to the Dow’s recent eye-popping run to the 20,000 point level. In fact, instead of propelling the industrial average along on any kind of a consistent basis – the stock is worth just over three points a day to the Dow’s performance – the shares are trading just $2 above the $85 a share they commanded exactly two years ago.

Almost half the analysts following the company – and realizing it’s the largest household and personal care products maker, it’s pretty well covered – do have a “buy” rating on the stock. But even those recommendations seem to come under the rubric, “yes, with a but …” or “no, with a maybe….”

Meanwhile, the company needs to focus on cost reductions, while piloting the newly reconstituted consumer staples giant through a persistently treacherous environment in which competition comes from both private label and eCommerce, as well as traditional purveyors, while consumers evidence a remaining reluctance to pay up for products. P&G just came through its third consecutive quarter of no pricing flexibility, Wells Fargo noted.

At the same time, the company has tried to identify $10 billion in cost savings, while boosting manufacturing and marketing efficiency, and reducing material costs at a time when the commodity deflation trends of the last several years have shown signs they’ve peaked.

And what’s been the biggest headwind – the foreign exchange environment – is expected to become an increasingly daunting obstacle. Procter & Gamble sells 60% of its products overseas, and can’t, on its own initiative, do much to blunt the impact of a strong dollar.

One of the leading arguments for investing in the consumer segment these days has been the prospect of consolidation. But having been a disaggregated the last several years, P&G doesn’t look much like a buyer. And even less like a takeover candidate. Per Goldman: “given P&G’s size, we view needle-moving M&A as unlikely.” Better plays on the consolidation theme – and, perhaps, better places to park money than in P&G overall, analysts suggest – are food names: Kraft Heinz (KHC), Post Holdings (POST) or Pinnacle Foods (PF) .

For P&G, putting its muscle behind the products that remain in its portfolio – even though those brands may be the most redoubtable names in its stable – is to embrace a mega-brand strategy, perhaps a dubious tactic in an era when barriers to entry are low.

Think of how disruptive online shaving operations have been to the $3 billion men’s shaving products business, a business that P&G’s Gillette once ruled. Since the arrival of the first online “shave club” concept just five years ago, Gillette’s share of the razor and blade business has declined to 59% from 71%, according to published reports. Are there other product categories that could face those kinds of pressures?

Where is Amazon.com (AMZN) in all of this? Experts agreed that Procter & Gamble got a late start in the eCommerce world, as its portfolio reductions of the last several years consumed managements’ attention.

And P&G’s management situation has attracted attention the last 18 years – and not the welcome kind. Durk Jager, seated as CEO in January 1999 didn’t last the year before giving way to A.G. Lafley, who, admittedly, won hosannahs on Wall Street. Lafley gave way to Robert McDonald in 2009, but by 2013, Lafley was summoned out of retirement to again pilot the ship. The company named P&G veteran David Taylor to succeed Lafley in November 2015. But lately, P&G has been known more as an exporter of management talent to other companies than for the prowess of its own stewards.

Add it up, Procter & Gamble isn’t a buy – too many headwinds. If you’ve held it for as long as two years, you’re effectively getting out where you’re getting in. Though holding onto the stock of P&G sounds pretty treacherous, as well. As Goldman concluded in its note, the “valuation is stretched, fundamentals are poised to disappoint given the challenged backdrop and it has relatively less to gain from either prospective tax policy changes (owing to already lower effective tax rates relative to peers) or M&A (owing to size.)”