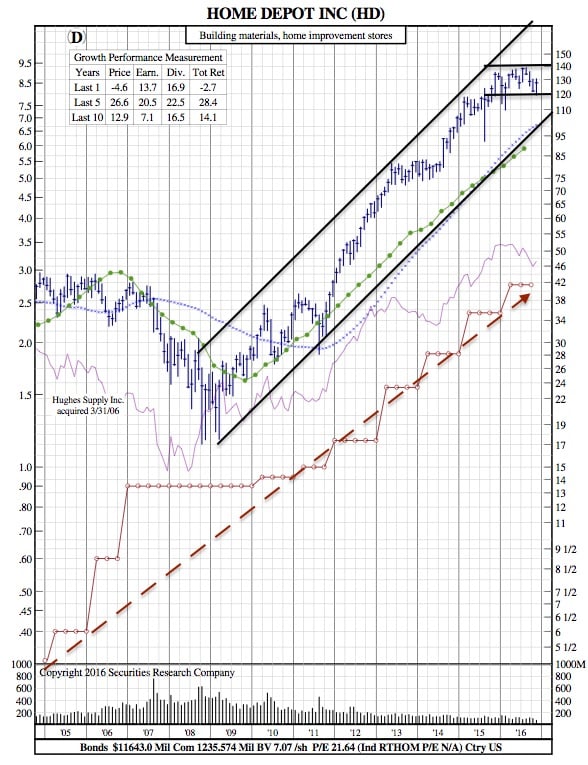

Home Depot 12-Year Chart in Light of Stagnant Sales Forecast

(Reuters) – Home Depot Inc, the No. 1 U.S. home improvement chain, did not lift its full-year sales forecast, implying a weaker-than-expected fourth quarter amid an improving housing market and higher consumer spending in the United States.

The company also raised its full-year earnings forecast only to account for lower tax provisions and outstanding share count.

Home Depot shares fell as much as 3 percent on Tuesday morning, reversing course from premarket when they gained after the company reported third-quarter profit and sales that beat analysts’ estimates.

The company, along with smaller rival Lowe’s Cos Inc is benefiting from higher wages and as rising home values as well as tightening for-sale inventories in many markets spur remodeling activity by homeowners.

Recent housing data has also suggested that overall residential construction may rise again in the current quarter.

However, Home Depot said it expects full-year net sales to rise about 6.3 percent and comparable sales to increase about 4.9 percent, maintaining a forecast that it first gave in mid-May when it reported first-quarter results.

Home Depot raised its adjusted earnings forecast by 2 cents to $6.33 per share for the year ending January 2017.

Analysts on average were expecting Home Depot’s net sales to increase 6.4 percent and the company to earn $6.33 per share, according to Thomson Reuters.

The full-year forecast implied that Home Depot was expecting comparable store sale to increase 3 percent in the fourth quarter, less than analysts’ estimates of 4 percent and the 5.5 percent growth in the third quarter, Credit Suisse analyst Seth Sigman wrote in a note.

“We don’t think there is anything in the Q3 results that would indicate a slowdown … and the outlook for 2017 seems quite healthy at this point,” Sigman said.

Home Depot said the number of customer transactions rose 2.4 percent in the third quarter. Customers also spent 3 percent more on average per transaction, the strongest in two years, according to Jefferies’ analysts.

“We believe home price appreciation, housing turnover, household formation and an aging housing stock in the U.S. continue to support growth in our business,” Chief Executive Craig Menear said on a conference call.

Transactions over $900 were up 11.3 percent, driven by sales of appliances and flooring and roofing products, Home Depot said. The company estimated sales related to Hurricane Matthew and flooding in Louisiana were about $100 million.

Net sales increased 6.1 percent to $23.15 billion in the quarter, while net earnings rose 14.1 percent to $1.97 billion, or $1.60 per share.

Analysts on average had expected a profit of $1.58 per share and sales of $23.04 billion.

HD 12-Year Chart:

Aside from the past year, Home Depot has had an incredible run. It’s 5-year averages across price, earnings, and dividends are 26.6%, 20.5%, and 22.5%, respectively — all coming from the recession recovery in 2008. For the foreseeable future however, it appears as if Home Depot’s price is cooling down and will begin to reflect the aforementioned sales outlook.