Finish Line Posts Stronger Than Expected Sales for Q2 (25-Year Chart Included)

Finish Line Inc. shares ($FINL), -3.88% rose 1.9% in premarket trade Friday, after the sporting goods retailer posted stronger-than-expected sales for its fiscal second quarter. Finish Line said it had net income of $22.1 million, or 53 cents a share, in the quarter to August 27, down from $25.9 million, or 57 cents a share, in the year-earlier period. Sales rose to $509.4 million from $483.2 million. The FactSet consensus was for EPS of 53 cents and sales of $495 million. Same-store sales rose 5.1%, well ahead of the FactSet consensus of 2.9%. The company said it now expects full-year same-store sales to grow 3% to 5%, and EPS to range from $1.50 to $1.56, which wrap around the current consensus for each metric. (MarketWatch)

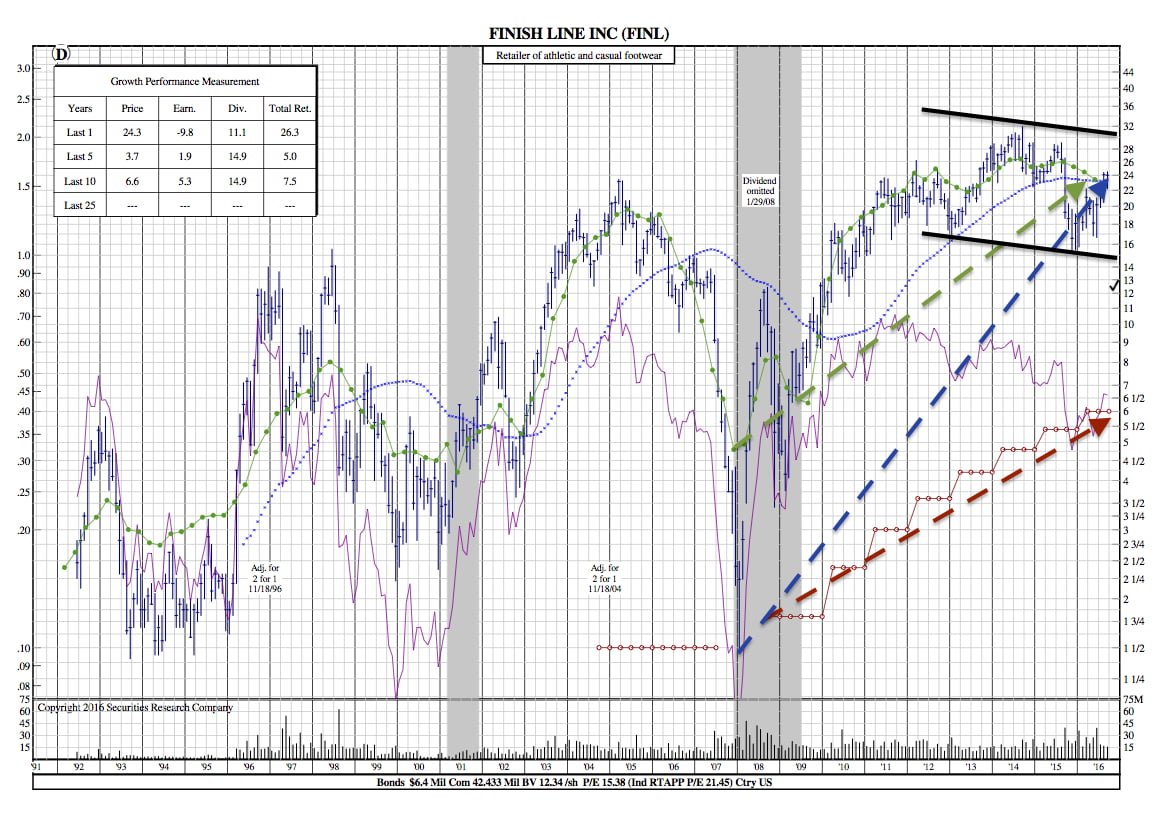

25-Year Chart:

After today’s news, it appears Finish Line may currently be a buying opportunity. Over the last year, earnings have declined at a rate of 9.8%; while price and dividends have grown at 24.3 and 11.1 percent, respectively. If the company forecast of same-store sales growth comes to fruition and is reflected in the expected EPS range, it justifies the price growth reflected in the 25-Year Chart.