Disney Beats on EPS, Misses on Revenue (12-Year Chart)

CNBC — The Walt Disney Company reported fiscal-second-quarter earnings that beat estimates on Tuesday, but revenue disappointed.

Here’s what the company reported compared to what Wall Street is expecting, according to Thomson Reuters consensus estimates:

- EPS: $1.50 vs. $1.41 expected

Revenue: $13.34 billion vs. $13.45 billion expected

The stock fell about 1 percent in after-hours trading. - Disney’s cable business, which falls under its media and networks segment, reported operating income of $1.79 billion, missing Street expectations for about $1.85 billion, according to StreetAccount.

The cable segment has typically brought in about 30 percent of Disney’s total revenue. Late April, ESPN said it would lay off 100 people as the sports network cuts costs and adapts itself to digital distribution.

Disney’s studio segment, however, bested even Wall Street’s optimistic expectations for a year-over-year increase of about 18 percent.

Disney’s “Beauty and the Beast” had a monster debut, bringing in $357 million worldwide on its opening weekend in March. The movie later crossed the $1 billion mark at the global box office.

Here’s how much revenue each segment brought in compared to what analysts projected, according to StreetAccount consensus estimates:

- Media and networks: $5.95 billion vs. $5.99 billion expected

Parks and resorts: $4.30 billion vs. $4.27 billion expected

Studio: $2.03 billion vs. $1.99 billion expected

Consumer and interactive: $1.06 billion vs. $1.17 billion

In March, Disney’s board announced it was extending Iger’s contract to July 2, 2019. The company has not yet named a successor for Iger.

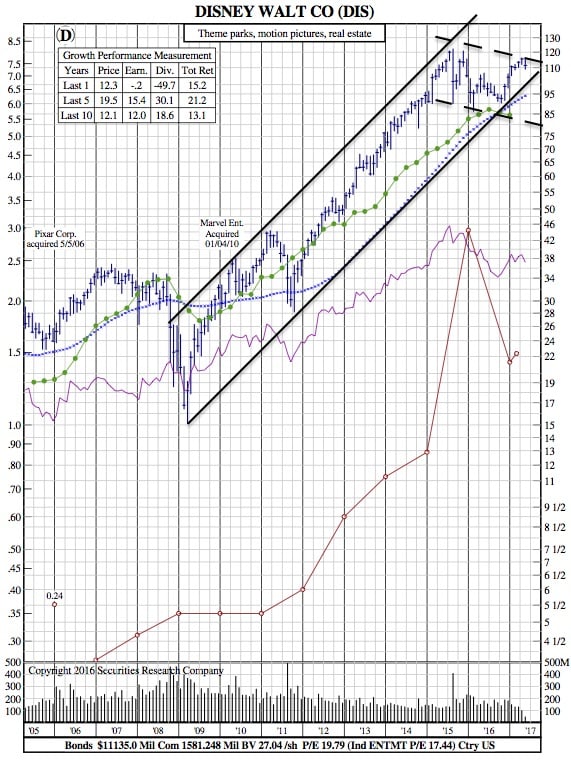

$DIS 12-Year Chart: