Delta Airlines Posts Better Than Expected Q1 Earnings Report (21-Month Chart)

Barron’s — Delta (DAL) rose Wednesday, thanks to a better-than-expected first-quarter earnings.

The airline said it earned 77 cents a share, on revenue that fell 1.1% year over year to $9.15 billion. Analysts were looking for EPS of 75 cents on revenue of $9.14 billion.

Delta said passenger unit revenues slipped 0.5% on lower capacity in the quarter. For the second quarter, it expects PRASM to grow between 1% and 3%, and for operating margins to come in between 17% and 19%.

Delta said that it had returned to full operations Sunday after severe weather in Atlanta caused it to cancel thousands of flights last week.

Raymond James’s Savanthi Syth reiterated an Outperform rating on the stock today:

Delta’s 1Q17 earnings report and 2017 outlook is likely to be received well by investors with indications of continued capacity discipline and 2Q17 EBIT margin guidance above expectations despite a 1 ppt impact from the recent severe weather. Additionally, 2Q17 PRASM guidance is in line to somewhat better than expectations, although it is unclear if the storms will be a boost or a drag on y/y PRASM. The positive outlook is likely to be somewhat tempered by recent guidance misses.

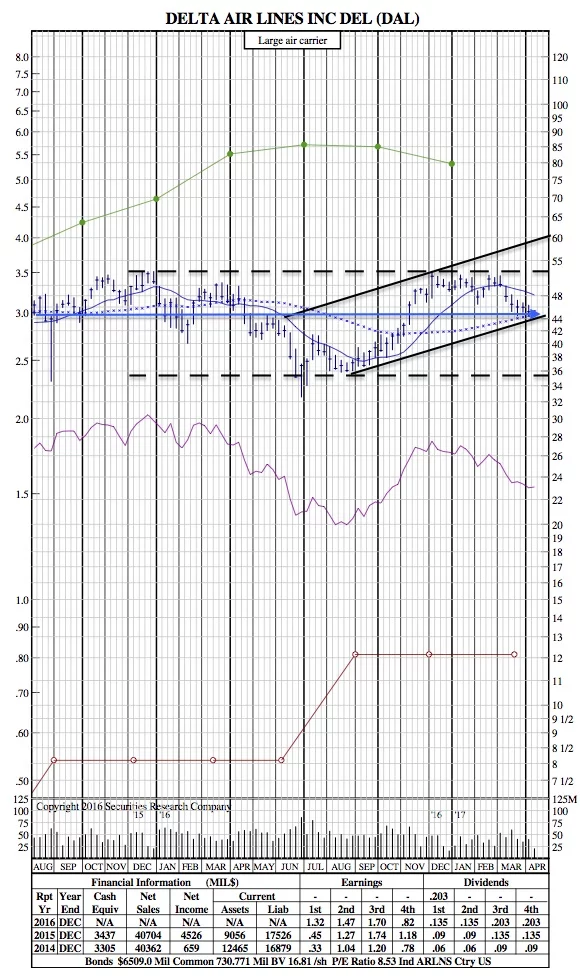

DAL 21-Month Chart: