Chipotle 2017 Outlook and 21-Month Chart

Barron’s — Shares of Chipotle Mexican Grill might look cheap at a recent $404 apiece, down from a peak of over $750 a year and a half ago. Don’t dig in yet, though. The Denver-based burrito chain is moving beyond a punishing sales decline caused by widespread 2015 outbreaks of E. coli, salmonella, and norovirus, but keeping a clean record from here while luring back lost customers could involve a long-term shift higher in sourcing and marketing costs.

Sales at longstanding stores have begun rebounding from their level a year ago, but they are still down from two years ago, and comparisons are about to become more difficult. At the same time, competition is heating up and labor costs are rising.

Our biggest beef with Chipotle (ticker: CMG), however, is its price. We don’t mean the $8-or-so burritos, which can weigh as much as yoga dumbbells. Those are a square enough deal. But the shares, up 8% in the past three months amid an activist-led board shuffling, trade at 49 times the consensus earnings estimate for 2017—a consensus that has been steadily falling. A healthy return for investors from here would require either that Chipotle blast past growth estimates in coming years or that shareholders maintain their enthusiasm as growth slows.

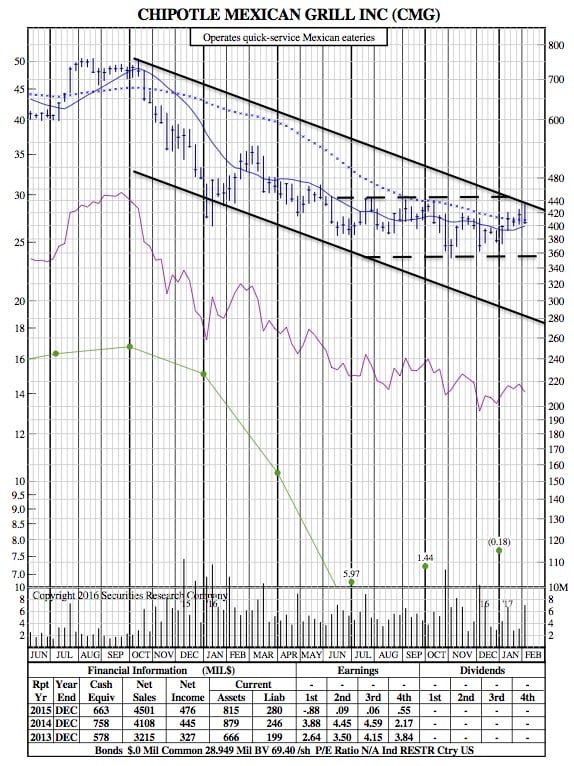

CMG 21-Month Chart:

IN PUBLIC STATEMENTS, Chipotle has said it’s investing in technology, training, and inspections to improve its supply chain and restaurants. It has begun preparing some of its food off-site. Ells has spoken frankly about the company’s stumbles. In December, co-CEO Monty Moran stepped down, putting Ells back in full control of his creation. Also in December, activist investor William Ackman reached a settlement with Chipotle that gives him control of two board seats.

We see no reason to doubt that food safety at Chipotle is improving and that fans can eat there with confidence. We have reservations, however, about the safety of earnings forecasts and the share price.

Veteran restaurant analyst Howard Penney at Hedgeye calls Chipotle’s E. coli troubles the worst he’s ever seen. “There’s an expense involved in serving safe food,” he says. “They need to invest in that. And now they need to invest in advertising.”

Those two efforts alone could raise costs by six percentage points of revenue for the foreseeable future, according to Penney, and that stands in the way of management’s stated goal to get back to peak volumes and margins. Increased advertising is important because Chipotle’s word-of-mouth advertising has turned negative. “It used to be ‘GMO-free organic,’ ” says Penney. “Now, it’s ‘Don’t go there or you’ll get sick.’ ”

Last quarter, same-store sales fell nearly 5%, Chipotle reported this past week. But same-store sales jumped by double-digit percentages in December and January. That’s partly because Chipotle has reached the anniversary of its initial downturn, making comparisons easier. Soon it will come up to the couponing anniversary, too. Investors should know by later this year whether the recovery is gathering pace or stalling.

While Chipotle works on its turnaround, the supply of fast-casual and casual restaurants is expanding by 4% a year, versus 1% growth in employment, a good proxy for demand growth, according to JPMorgan analyst John Ivankoe. He downgraded Chipotle stock to Neutral from Overweight last month, citing rising competition, wage inflation from a tight labor market and minimum-wage hikes, and flattening commodity prices after years of declines. Worker retention could be especially important for Chipotle if it is to improve food handling at its restaurants.

Management wants to expand the restaurant base by around 9% this year. That’s an unusual ambition for a company trying to work its way back from a decline in same-store sales. The aggregate number of fast-casual restaurants has doubled over the past decade, according to a Morgan Stanley report last week. “We think this will weigh on Chipotle as it seeks to recapture customers that scattered,” the authors conclude.

Earnings for Chipotle peaked above $15 a share in 2015. Last year, the company took a bath. This year, Wall Street is predicting a rebound to $8.25 in earnings. That’s down from a consensus of over $10 back in September.