Bullish 12-Year Charts for Two Chemical Stocks

LyondellBasell Industries

A relatively unknown chemicals stock that investors may be interested in is, LyondellBasell Industries NV LYB, -2.17% In addition to being a $35 billion player in the chemicals space, it’s the remnants of an ill-timed leveraged buyout that closed in 2007, right before the financial crisis, and went into bankruptcy less than a year later.

Lyondell exited bankruptcy in 2010. It’s been humming along ever since with 220% gains since re-entering the stock market about six years ago vs. 85% or so for the S&P 500 SPX, +0.13% in the same period.

Shares topped out in 2014, as they did for many chemicals companies, but the company has been much more resilient than its peers from an income perspective. Its dividend has soared from $2.10 annually in 2013 to what should be $3.33 this year after its fourth-quarter payout — a 58% increase in just three years, and a current yield of 4.0%. Even after these boosts, payouts are only about a third of total earnings and there’s plenty of upside to distributions ahead.

From a valuation perspective, the stock is quite attractive with a forward P/E of less than 9. And while growth isn’t burning down the house, with a projected 6% increase in sales next fiscal year and a modest 5% growth prediction for earnings, at least it’s moving the right direction.

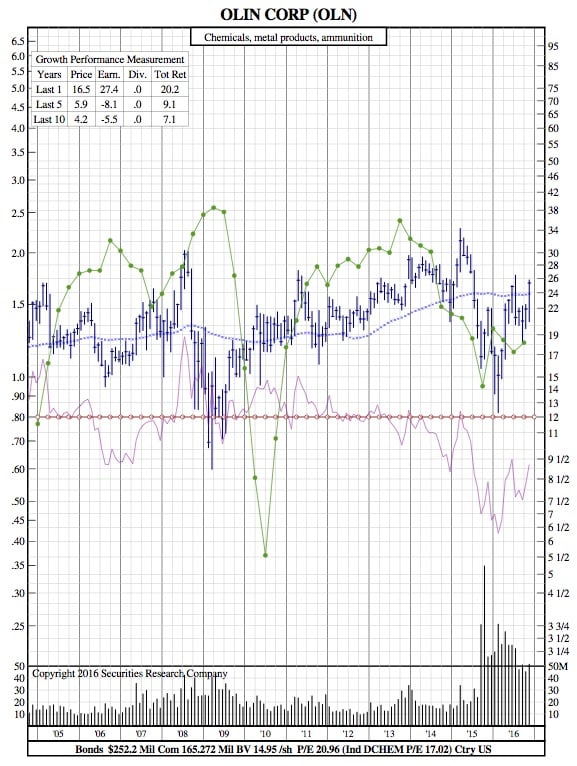

Olin Corp.

If you haven’t heard of Olin Corp. OLN, -0.16% then certainly you’ve heard of its Winchester ammunition line. About half of all income comes from this Winchester group, even if the company’s chlor alkalai chemicals segment generates 60% of sales.

Winchester is a huge plus for Olin, as concern over gun rights fuels record firearm sales in 2016. It’s not just sportsmen and NRA members fueling this segment. In 2016, Olin won a two separate five-year contracts with the U.S. army that will generate about $375 million in revenue.

Stepping back, Olin is growing outside this ammunition segment, with the 2015 acquisition of Dow Chemical’s clor-alkalai business allowing it to double its overall revenue this year compared with last. And profitability in this segment is only getting better since as much as 85% of electricity at Olin plants is generated from natural gas, and depressed energy prices make it cheaper to operate.

The icing on the cake: Olin does 61% of its total revenue at home, meaning less exposure to trade trouble or current pressures compared with other multinational industrial companies.