Bank of America Beats Earnings Expectations – Profits up 6.6% From Last Year (21-Month Chart Included)

Article: Oct 17 (Reuters) – Bank of America Corp, the second-largest U.S. bank by assets, reported its first profit increase in three quarters on Monday, foiling expectations for another drop, as bond trading surged and expenses fell.

Like rivals JPMorgan and Citigroup, Bank of America enjoyed a boost from a resurgence in trading. That came as clients scrambled to reposition after Britain’s surprise June vote to leave the European Union, and changing expectations for monetary policy in the United States, Europe and Japan.

Chief Executive Brian Moynihan’s cost-cutting campaign also paid off as expenses fell in each of its four major business segments.

On a pretax basis, quarterly profit was at its highest in a decade. Net income attributable to shareholders rose 6.6 percent to $4.45 billion in the third quarter ended Sept. 30 from a year ago. Earnings per share rose to 41 cents, from 38 cents in the same period of 2015. Analysts, on average, had estimated a decline to 34 cents a share.

Revenue grew 3 percent to $21.64 billion, beating the $20.97 billion expected by analysts.

Net profit in Bank of America’s trading-focused Global Markets arm jumped 34 percent from a year earlier as revenue from dealing fixed-income securities, currencies and commodities surged 39 percent. Equity trading revenue fell 17 percent.

Last week, JPMorgan reported a 48 percent increase in bond trading and Citi posted a 35 percent gain. Trading in stocks rose 1 percent and fell 34 percent respectively at JPMorgan and Citi.

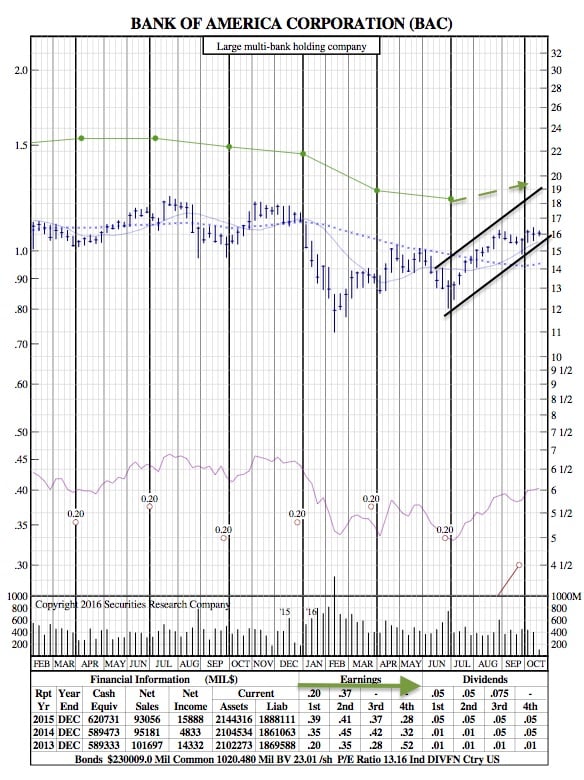

21-Month Chart:

$BAC has been on a healthy climb since July, as noted in the price channel below. This bullish increase should increase, albeit somewhat slowly, after traders were reluctant to increase the price at too high of a percentage rate after the ER on October 17.