Apple’s Earnings and iPhone Sales Both Down…Is this a Buying Opportunity? (21-Month Chart Included)

Article — TechCrunch

Ahead of the Christmas retail season, Apple reported its fourth-quarter earnings that were directly in-line with what Wall Street was expecting. Almost everything came as expected as the company stands in a basic holding pattern, waiting for the first full quarter of its next generation of iPhone sales to come in throughout the holiday season. It’s not super surprising, but it’s still kind of a breath of fresh air for the company, which has been on a rollercoaster for the past two quarters.

Apple reported revenue of $46.9 billion and earnings of $1.67 per share. The company shipped 45.5 million iPhones, 9.3 million iPads and 4.9 million Macs. Wall street was looking for earnings of $1.65 per share on revenue of $46.9 billion, with iPhone sales of 45 million. Wall street was looking for iPad sales of 9.1 million.

Now, everyone will be looking at the next quarter. Apple is forecasting revenue between $76 billion and $78 billion — basically in line with what Wall Street was expecting. Last year, Apple recorded $75.9 billion in revenue, so that forecast would signal a potential reversal of its revenue declines for the company, which has dogged it for several quarters. It’s a slight level of growth, but in an environment where the smartphone market has been largely saturated and with increasing competition on the low end, that’s a good sign for Apple.

There’s going to be one big challenge for Apple: getting enough smartphones out to customers. If you try to buy the iPhone 7 Plus you’ll see that there are weeks-long waits for shipping dates. With the Galaxy Note 7 fiasco, Apple needs to capitalize on the momentum it can gain on its core competitor, and that means it needs to make enough phones that people can buy on a whim.

One important note in the report was that Apple’s average selling price for the iPhone — a metric that basically determines whether people are buying Apple’s most expensive, high-end phones — fell beneath Wall Street’s expectations. There’s always concern that lower-end phones are cannibalizing Apple’s high-end phones, especially with the highly-priced Plus models coming out. Apple released the smaller iPhone SE earlier this year, which may be cutting into things.

To be completely expected and an exclamation point on the whole thing: Apple shares fell about 2% in extended trading after swinging wildly in the third and second quarter reports this year.

- 4Q Earnings: $1.67 per share vs. Wall Street’s $1.65 expectations

- 4Q Revenue: $46.9 billion, in line with Wall Street, down from $51.5 billion last year

- Gross margin: 38%

- iPhone sales: 45.5 million vs. Wall Street’s 45 million estimates

- Mac sales: 4.8 million

- iPad sales: 9.2 million

Apple’s past two-quarters have, primarily, shown that its smartphone business is starting to slow. The company released its new iPhones, the iPhone 7 and the iPhone 7 Plus, this quarter but we really aren’t going to see any kind of material impact. As expected, iPhone sales fell once again this quarter, with last year’s fourth-quarter sales coming in at 48.1 million. Earlier this year, Apple broke its extended streak of growing iPhone sales, and that trend continues.

Going into the fourth quarter, Apple has one huge tailwind that it wasn’t expecting: the Galaxy Note 7 debacle. After a series of investigations showed that the Note 7 was prone to exploding, the company is pulling the plug on the Note 7 — which was basically one of the few phones that could place a significant dent on the iPhone 7 Plus.

That’s going to be critical for Apple going forward. The company, while still in a holding pattern, is still going to need as much help as it can get. In an ironically Microsoft-y problem, Apple’s shares are largely unchanged in the past year, and in the past two years are only up around 12%.

The company is continuing to ship new products, but as smartphone saturation kicks in and markets start to slow down, it needs to figure out to roll out new products that will make the ecosystem more sticky as a whole and promote cross-device sales.

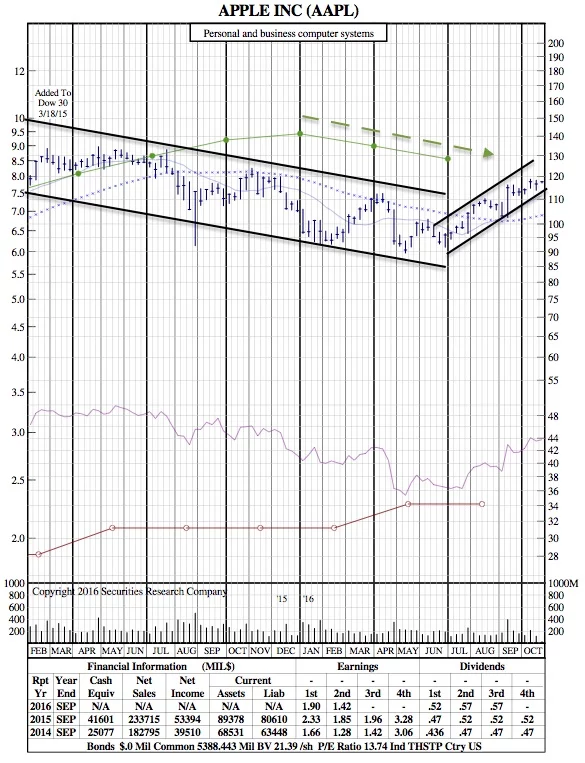

21-Month Chart: