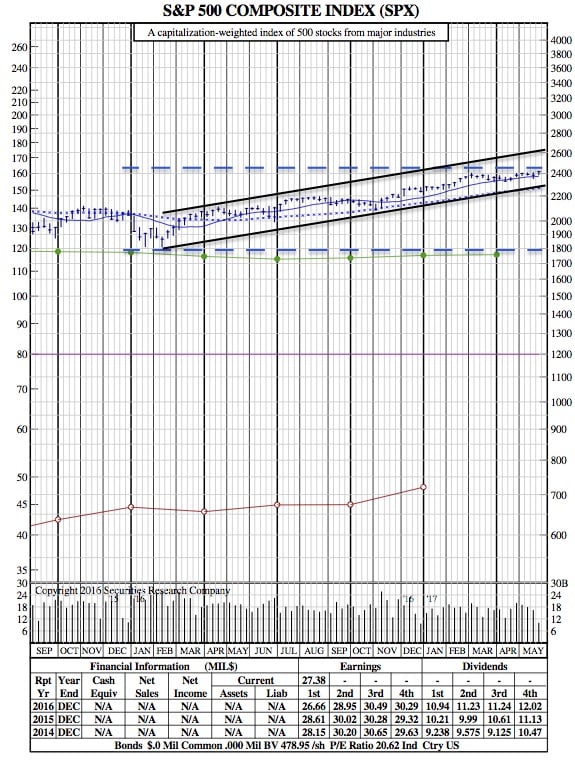

May 26th, 2017: A Week In Review (SPX 21-Month Chart)

Bloomberg — It usually doesn’t work this way: stocks vaulting to records, and bearish traders getting more aggressive. Lately, it has.

The S&P 500 Index has climbed 7.9 percent since January, including its biggest gain since April in the just-completed week. At the same time, short interest as a proportion of total shares outstanding has also expanded, rising by 0.3 percentage point to 3.9 percent. Never before has an equity advance as big as this year’s occurred simultaneously with more short sales, according to exchange data compiled by Bloomberg that goes back to 2008.

It’s not hard to see why bears are standing firm when any mishap from President Donald Trump could wreak havoc in a market where valuations sit at levels not seen since the dot-com era. Just one week ago, stocks suffered their worst rout in eight months as concerns over Trump’s presidency surfaced. Yet the loss was quickly erased and the S&P 500 rose seven straight days to reach record highs.

The S&P 500 rose 1.4 percent to 2,415.82 over the five days, finishing the week with the best gain in a month. The Dow Jones Industrial Average added 275.44 points, or 1.3 percent, to 21,080.28. Technology shares continued to outperform as the Nasdaq 100 Index jumped 2.4 percent.

The challenge for short sellers is how long they can stay solvent before being forced to buy back the shares that they have borrowed and sold. And the pressure to cover is building. A Goldman Sachs Group Inc. basket of most-shorted stocks has jumped 6 percent this quarter, almost triple the return in the S&P 500.

“This continues to be a bull market that everyone loves to hate,” said Jeff Korzenik, the Chicago-based chief investment strategist at Fifth Third Bancorp, which oversees $33 billion. “It’s one reason why we’re bullish. There are none of these euphorias that’s associated with market tops.”

The steady drumbeat of gains has made life difficult for bears. Hedge funds that aim to profit from short bets have lost money almost every year since 2009, a stretch where share prices more than tripled, according to Hedge Fund Research.

Bears have generally been willing to back off during equity rallies. Take last year for instance. When the S&P 500 broke out of a two-year trading range, climbing five straight months through July, short sales posted the biggest decline in four years.

SPX 21-Month Chart:

This time, that willingness to surrender is nowhere to be found. Even as hedge funds with a bearish bias are down 5 percent this year, they’re gearing up for lower share prices. At 3.9 percent, short interest sat at the highest level since November.

This time, that willingness to surrender is nowhere to be found. Even as hedge funds with a bearish bias are down 5 percent this year, they’re gearing up for lower share prices. At 3.9 percent, short interest sat at the highest level since November.

The resistance among short sellers, while at odds with their own behavior in the past, seems to be consistent with the defensive stance prevailing the market.

Investors are pulling money out of stocks after the initial rush to buy faded along with the optimism over Trump’s pro-growth policy. They have withdrawn $20 billion from exchange-traded funds and mutual funds this quarter, reversing about one-third of the inflows seen between November and March, according to data compiled by Bloomberg and Investment Company Institute.

Bullish bets are also shrinking in the futures market. Net-long positions in S&P 500 contracts held by large speculators fell in seven of the last eight weeks and were closer to turning net short than any time since December, data compiled by Commodity Futures Trading Commission show.

“The market appears relatively cautious by historical standards,” Pavilion Global Markets Ltd. strategists led by Alex Bellefleur wrote in a note. “The bullish view is that some of these shorts will have to be covered at some point, lengthening the rally.”