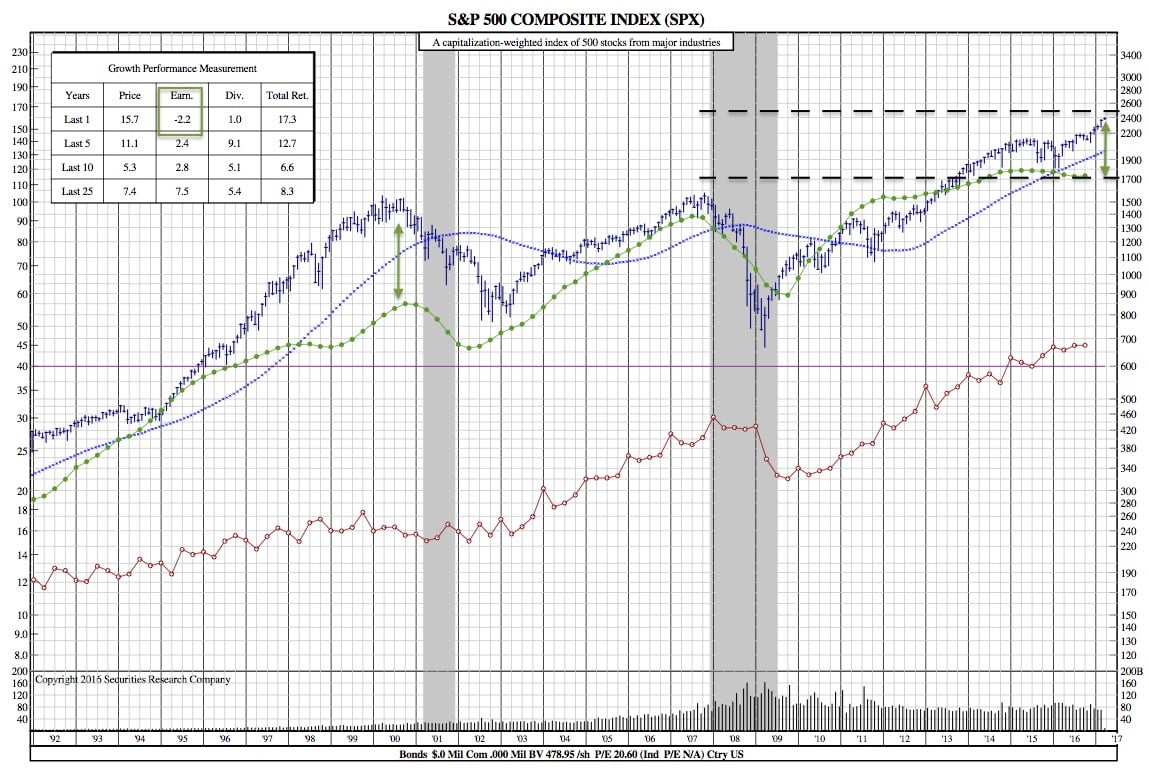

Is there a High Risk of “Correction” in the Air? Goldman thinks so… (S&P 500 25-Year Chart)

CNBC — Equity markets are facing a “quite high” risk of a correction but it won’t be enough to throttle the bull market altogether, the chief global equities strategist at Goldman Sachs has told CNBC.

Furthermore, the elevated risk of a correction is not so much due to politics — as is widely believed — as growth dynamics, according to Peter Oppenheimer, speaking to CNBC Tuesday

“We think the trigger is probably not going to be so much politics … But more really the fundamental peaking of growth momentum which has been so supportive for the reflation trade in recent months, at a time when U.S. rates are starting to increase again, coupled with the very high valuations that we already have,” he explained before noting that this would not, however, signify the beginning of a complete reversal in shareholders’ fortunes.

“A correction – if we’re getting one – is not going to be the end of bull market. I think that will probably continue for some time,” he added.

Oppenheimer was speaking ahead of the U.S. market open on Tuesday, with equity futures pointing higher after the Dow Jones (Dow Jones Global Indexes: .DJI) on Monday notched up its eighth straight losing session to cement its longest streak of negative daily returns since 2011. The S&P 500 index has fared little better of late, posting its seventh negative session in the past eight on Monday.

“We have taken a view that the market has overpriced the ability for the new administration to push through some of the things that the market is priced for. Aggressive tax cuts, fiscal policy, full deregulation in many industries,” the equity strategist outlined.

“If you look at some of the more cyclical parts of the market which are very sensitive to these valuations, they really ran ahead of macro data,” Oppenheimer continued.

Yet, pointing to the fact that the S&P 500 (^GSPC) finished only 10 points lower yesterday despite dropping 94 points at certain points during Monday’s trading session, strategists at Deutsche Bank questioned the extent to which Trump’s “most radical policies were priced into markets” in an email to clients on Tuesday.

S&P 500 25-Year Chart:

“There is an argument for saying that such trades weren’t actually priced in much anyway,” said the note, continuing on to suggest that last week’s health-care fiasco shouldn’t hit markets too much unless the global growth story deteriorates.

“There is an argument for saying that such trades weren’t actually priced in much anyway,” said the note, continuing on to suggest that last week’s health-care fiasco shouldn’t hit markets too much unless the global growth story deteriorates.

“Having said that, failure in the tax reform agenda will surely have more impact on animal spirits given its economic importance,” concluded the strategists on a qualifying note.

While Oppenheimer sees a potential lapse in the performance of U.S. equities ahead, he expects price momentum in other economies to hold up better, especially as political fears begin to recede in Europe.

The equity strategist pointed to both the overall positive trajectory for global growth in addition to the persistence of a significant valuation gap between U.S. equity markets and, generally speaking, those in Asia, emerging markets and Europe.

“We could well see therefore a relatively flat market in the U.S. throughout the remainder of the year and some more positive gains in other markets, Europe in particular,” Oppenheimer proposed.