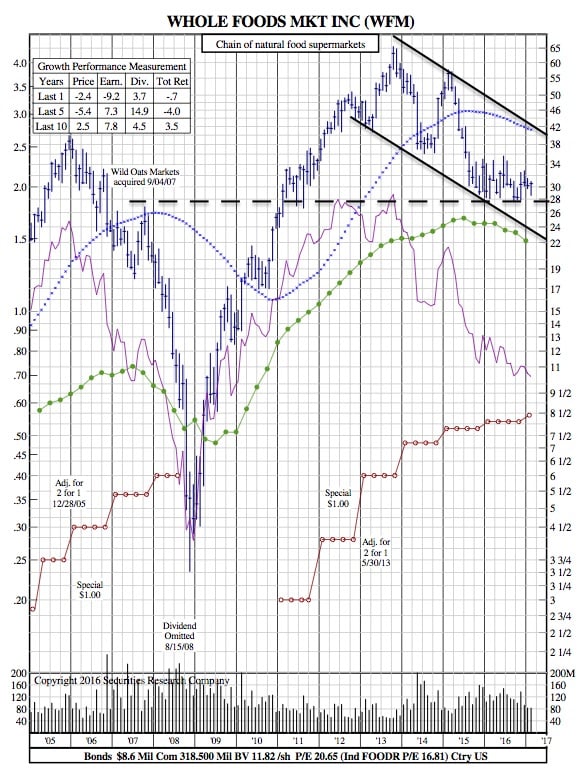

Whole Foods Market 12-Year Chart after Goldman Sachs Reduces Stake

Investopedia — The fund management arm of Goldman Sachs, Goldman Sachs Asset Management (GSAM), disclosed that it has reduced its stake in Whole Foods Market (WFM) in recent regulatory filings.

GSAM reduced its holdings in the organic and natural food retailer to 6.2 million shares, equivalent to a 1.9% stake in WFM, from roughly 20.4 million shares, a 6% equivalence. Since GSAM’s skate in WFM is now less than 5%, the fund manager isn’t obligated to make regulatory filings regarding the WFM shares it holds. In essence, GSAM could dissolve its entire WFM holdings without notifying the public.

This comes at a time when Whole Foods is struggling to grow sales at its established stores. The grocer recently announced that same store sale declined by 2.4% in its fiscal year 2017 first quarter. However, the total sales increase of 1.9% it recorded was the impact of new stores. That was the sixth straight quarter comps have fallen at WFM. Now, the grocer is dialing back on new store openings.

Going by the words from executives, chances are this quarter will be the seventh consecutive quarter of comps decline.

Meanwhile, Whole Foods is holding its annual shareholder’s meeting today (February 17) and reports have it that an unsatisfactory outcome could lead to investor protests within the next six months. Although, the company said it will use data to improve efficiency and focus on its core customers – the Whole Foodies.

Is WFM Misplacing Priorities?

In the wake of its recent quarterly filing, different views have been flying around Wall Street regarding Whole Foods. MarketWatch quoted Julie Goodridge, founder of NorthStar Asset Management as saying, “Where are the next-generation kids who are talking about farm-to-table? They are trying to embrace that crowd in a groovy way but they’ve missed the boat. That’s a problem.”

In essence, Goodridge is saying that Whole Foods is focusing on the wrong set of customers (the millennials). Instead, it should keep focusing on the Baby Boomers and Gen Xers who helped grow its business. Perhaps that’s what investors will want to hear today.

WFM 12-Year Chart: