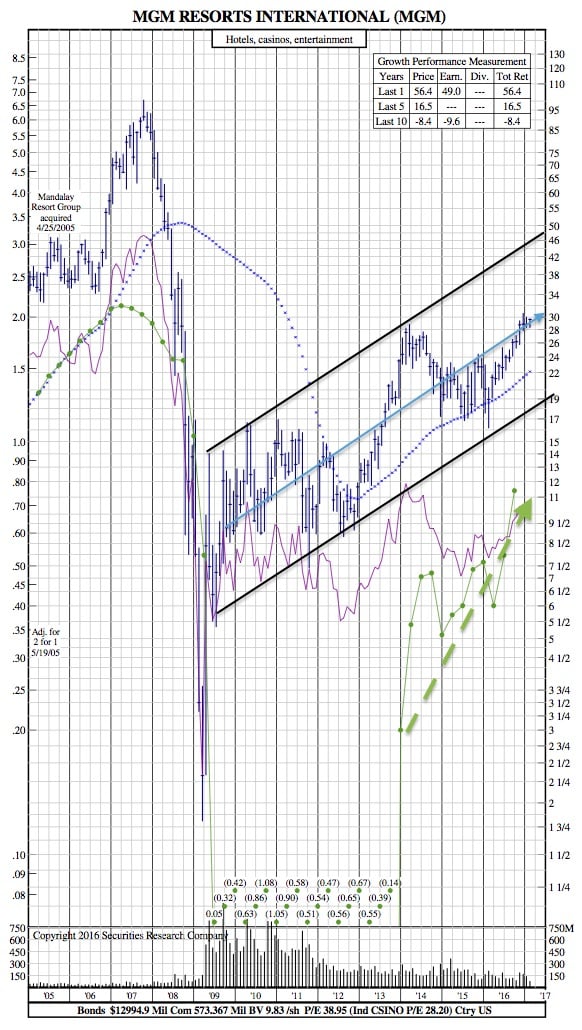

MGM Resorts International 12-Year Chart after a Disappointing Q4

CNBC — Shares of MGM Resorts International sank as much as 9 percent Thursday after it reported lower-than-expected fourth-quarter results due to softness in its Las Vegas convention business.

“MGM’s [fourth-quarter] print was full of various puts and takes,” said Stifel analyst Steven Wieczynski in a research note. “Furthermore, the margin softness is likely to validate bearish investors’ take that the margin improvement story is losing steam.”

Specifically, the casino giant showed weakness at its Mandalay Bay and MGM Grand Las Vegas properties in Las Vegas.

MGM shares fell as much as 9 percent intraday, with volume more than four times its 10-day average. Even with Thursday’s losses, the stock remains up more than 40 percent in the past 12 months.

“The company’s domestic resorts were impacted by a lower number of convention room nights compared to the prior year quarter, primarily driven by the October holiday calendar shift as well as the rotation and timing of certain conventions,” MGM said in its earnings release.

In comments during MGM’s Thursday earnings call, CEO Jim Murren said, “I want to pause for a moment and look at where our stock is and clear up a little bit of confusion. I think we should have been more clear in our third-quarter call.”

Murren said management earlier had cautioned the December quarter “would be challenging” as a result of the timing of the Jewish holidays. Indeed, he said that between the holiday shift and “timing of a big group” in the convention business that there was an impact to EBITDA (or earnings before interest, taxes, depreciation and amortization).

Earnings per share in the October-December quarter were 4 cents compared with a loss in the year-ago quarter of $1.38, which included a $1.33 per share charge related to the 2011 MGM China acquisition. Analysts’ consensus estimate for the quarter was a profit of 21 cents a share.

The company’s domestic resorts business saw its revenue rise 17 percent from the year-ago quarter, but just 2 percent on a “same-store basis,” which excludes contributions from the Borgata casino in Atlantic City as well as the recently opened MGM National Harbor in Maryland and a casino sold in Reno.

Adjusted property EBITDA was $493 million at the domestic resorts, up 14 percent over the year-earlier quarter but 1 percent on a same-store basis.

“EBITDA fell well short of forecasts, most notably on the Strip,” Deutsche Bank analyst Carlo Santarelli said in a research note Thursday. He had forecast EBITDA would be $555 million and noted that Consensus Metrix showed a consensus of $543 million.

Santarelli added, “We believe the shift from convention to leisure/casino channels at Mandalay/MGM Grand was more painful than expected from a [year-over-year] perspective and contributed to the miss.”

MGM said in a release the reduced convention room nights in the domestic business “were replaced primarily with casino room nights, which benefited our table games and slots business and was offset by lower catering and banquets and production services.”

“While EBITDA fell well short of our estimates, the stronger revenues and property specific misses suggest results will likely be a bump in the road versus a change in trajectory for the business,” said Goldman Sachs analyst Stephen Grambling in a note.

He added that the company’s initiation of a dividend of 11 cents per share in the quarter “reflects an improving balance sheet and ongoing growth opportunities, which could attract a new set of investors.”

MGM Resorts International 12-Year Chart: