Top 5 Growth Stocks for 2017 and Their 21-Month Charts

A growth stock is a company whose earnings are expected to grow at an above-average rate relative to the market. Growth companies also typically have unique or advanced product lines. A growth company may hold a patent for a new and promising technology or product or have a history of being at the forefront of industry developments. This is the primary reason that growth companies do not pay out dividends. The company’s goals are best served by reinvesting its earnings into product research and development, thereby fueling expansion.

A growth stock is a company whose earnings are expected to grow at an above-average rate relative to the market. Growth companies also typically have unique or advanced product lines. A growth company may hold a patent for a new and promising technology or product or have a history of being at the forefront of industry developments. This is the primary reason that growth companies do not pay out dividends. The company’s goals are best served by reinvesting its earnings into product research and development, thereby fueling expansion.

Below are the top 5 growth stocks for 2017:

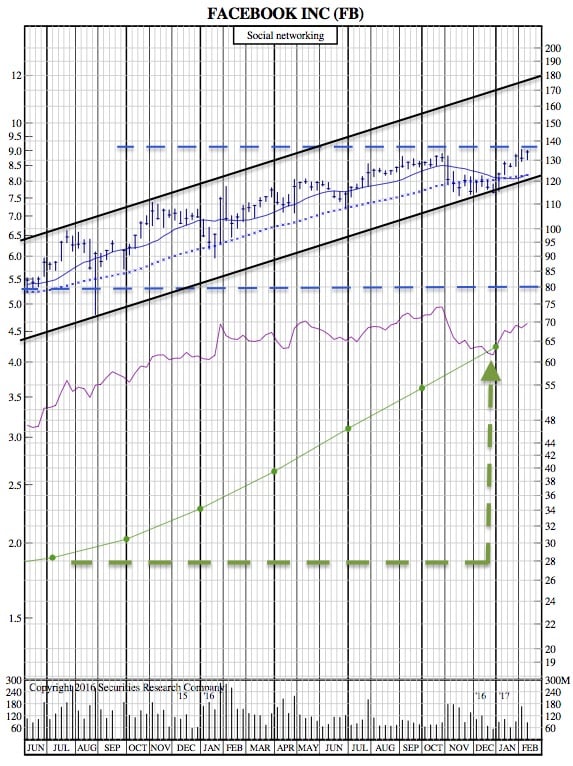

Facebook

Despite nearly sextupling in price over the past five years, Facebook continues to put Wall Street’s profit projections to shame. The third-quarter earnings results at Facebook speak for themselves. Daily active users shot higher by 17% year-over-year to 1.18 billion, while mobile daily active users have now hit 1.09 billion. Facebook also announced 1.79 billion monthly active users, or nearly a quarter of the people on the planet.

What’s most impressive about Facebook’s Q3 performance is that its 59% year-over-year advertising revenue growth led to a 166% jump in net income. Expenses are growing at less than half the rate of revenue, and it’s a clear indication of Facebook’s pricing power as an advertiser, a testament to its data culling prowess for advertisers, and an indication that businesses are eager to use Facebook’s advertising services.

The bottom line is this: until Facebook gives Wall Street a reason to worry, don’t. With its full-year EPS expected to essentially double from an estimated $4.09 in 2016 to $8.08 by 2019 on the back of a $30 billion increase in revenue from $27 billion to $57 billion, Facebook remains an intriguing growth stock that could be worth buying. — Bloomberg

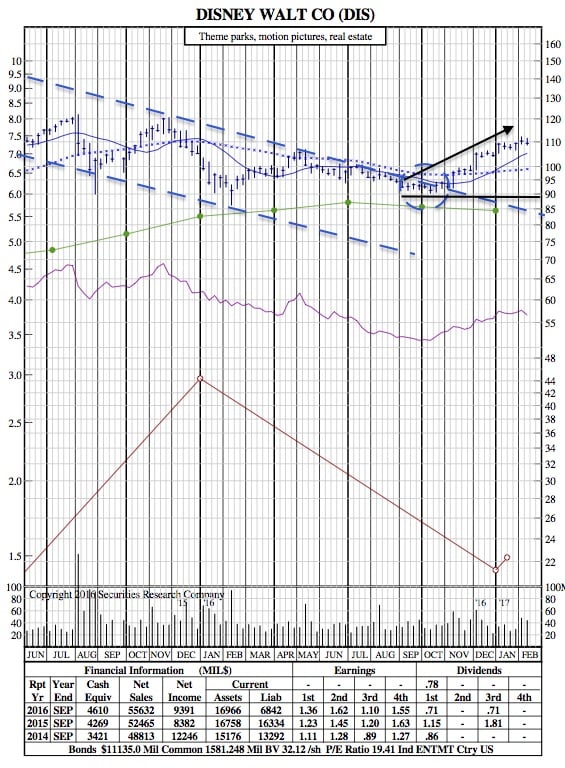

2. Walt Disney

With $45 billion in annual revenues, Disney can’t grow at the pace of smaller, up-and-coming businesses. But it offers investors the benefits of a blue-chip company that’s still capable of market-beating growth. Analysts estimate that Disney’s earnings will rise an annualized 16% over the next three years, well above the overall market’s growth rate. Even allowing for typical Wall Street over-optimism, there is good reason to believe that Disney’s growth rate will stay above the blue-chip average.

The key to the company’s success is its ESPN juggernaut. Led by the sports channels, Disney’s cable networks now generate 52% of the company’s total operating profit. But beyond cable, Disney’s ability to consistently find new ways to make money from its treasure trove of assets—from Mickey to Buzz Lightyear and Captain America—is unparalleled in the media industry, says Morningstar analyst Peter Wahlstrom. What’s more, in the boom-or-bust movie business, Disney’s 2012 acquisition of the rights to the Star Wars franchise heralded what FBR Capital Markets analysts say is a major shift by the studio unit. By focusing more on films with proven track records such as Star Wars (Episode VII is due out in late 2015), Disney aims for a “much more profitable, less risky” slate of future releases, FBR says. Nothing wrong with sticking with what works. — The Street

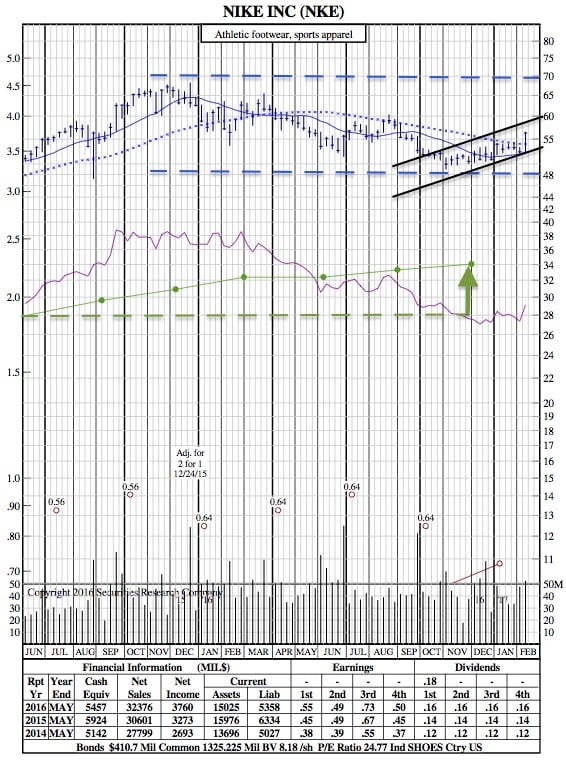

3. Nike

Nike has been hit by a confluence of factors in recent quarters. Domestically, the U.S. has trudged through a weak retail environment, while China’s GDP growth has slowed. Nike is counting on its expansion in China to be a major growth driver in the years that lie ahead, and thus a slowdown in growth for China has some investors concerned. However, both concerns could be misplaced since they ignore the loyalty of consumers to the Nike brand.

On top of relying on e-commerce, Nike is betting big on the future of women’s apparel and accessories. Nike’s plan to get to $50 billion in revenue by 2020 relies on a doubling in women’s apparel revenue from $5.5 billion to $11 billion. Aside from targeted marketing toward women, Nike hopes its innovation and partnerships in digital wearable technologies will strike a chord with the female consumer.

Considering Nike has double-digit annual EPS growth potential through 2020, its recent share price decline looks like the perfect opportunity to gobble up this growth stock. — Seeking Alpha

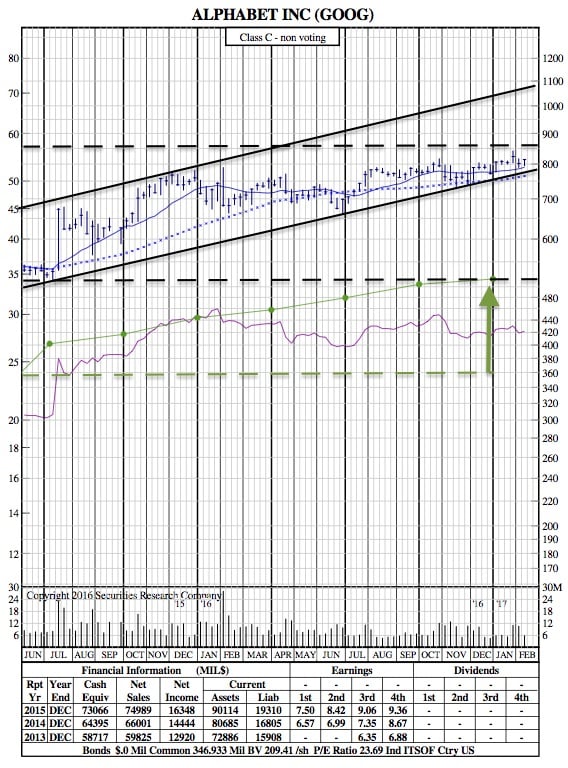

4. Google

As the internet and new media continue to mature, there are a handful of very clear winners. Alphabet Inc (NASDAQ: GOOG, NASDAQ: GOOGL), formerly Google, is one of them. Alphabet obviously dominates internet search and the advertising dollars that come with it via its Google search engine. But Alphabet is also the owner of the word’s largest smartphone and tablet operating system in Android, is a leader in driverless car technology, and is emerging as a media power via YouTube.

Alphabet has been a popular growth stock for a long time, and it is represented in “FANG” stocks (“G” is for Google). So it’s really not novel to include Alphabet on a list of leading growth stocks. — The Street

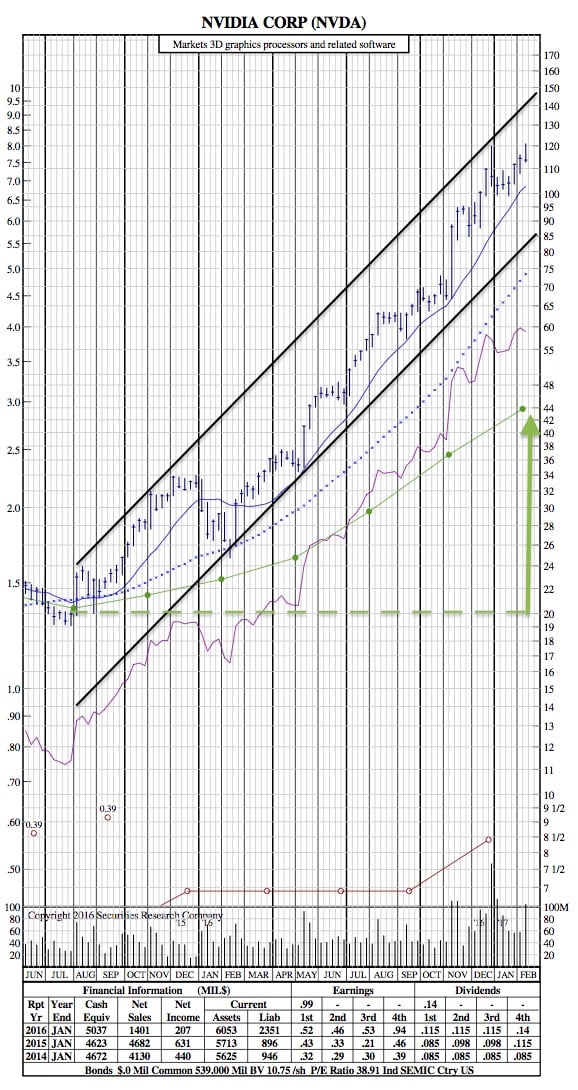

Shares of NVIDIA Corporation have nearly quadrupled over the past year as of this writing, helped by its stunningly better-than-expected fiscal third-quarter report in November.

Revenue in NVIDIA’s most recent quarter climbed 54% year over year, to $2 billion, while adjusted earnings per share more than doubled, to $0.94. Both figures crushed expectations, which had called for revenue and earnings of $1.69 billion and $0.69 per share, respectively. The reasons behind that beat are most compelling; NVIDIA enjoyed broad-based revenue growth across not only its core gaming segment (up 63%, to $1.2 billion), but also in data centers (up 193%, to $240 million), automotive (up 61%, to $127 million), and professional visualization (up a modest 9%, to $207 million).

It was hardly surprising, then, that even after its initial post-earnings pop, NVIDIA stock continued to climb in December as analysts voiced optimism for its momentum to continue. Goldman Sachs, for example, added NVIDIA to its “conviction buy list,” citing its belief the company should be able to continue outgrowing its peers given positive secular trends in gaming, virtual reality, AI/machine learning, and its central position in the burgeoning automotive chip market. — Bloomberg