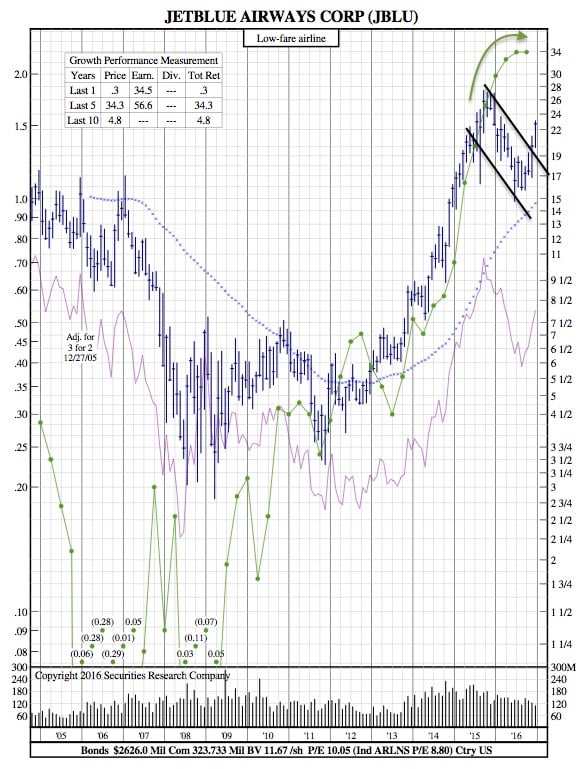

JetBlue 12-Year Chart and Addressing the Company’s Possible Risks

Barrons — JetBlue stock has soared 30% over the past month and a half, as demand for airplane tickets has jumped and the company has made promising comments about its prospects. But one analyst thinks investors may be overlooking the company’s risks.

Raymond James analyst Savanthi Syth downgraded JetBlue shares to Market Perform from Outperform on Wednesday, essentially recommending that clients hold the stock rather than buy more shares. Syth’s concern is that the company is expanding into too many new markets, which could make it harder to keep planes filled. Much of that is related to JetBlue’s decision to add service to Cuba, but the company is also adding service in other areas too. That decision to expand capacity by about 7.5% in 2017 comes as most other carriers are slowing expansion to make sure the domestic market doesn’t get oversaturated and cause them to lower fares.

JetBlue’s decision to reconfigure its cabins to add more seats is also taking longer than expected, Syth noted.

JetBlue has also bought back less of its own shares than Syth had expected — another potential negative for the stock.

Big Picture: JetBlue’s shares have jumped since November, but the rise could be curtailed as the company expands more quickly than other airlines.

JetBlue 12-Year Chart: