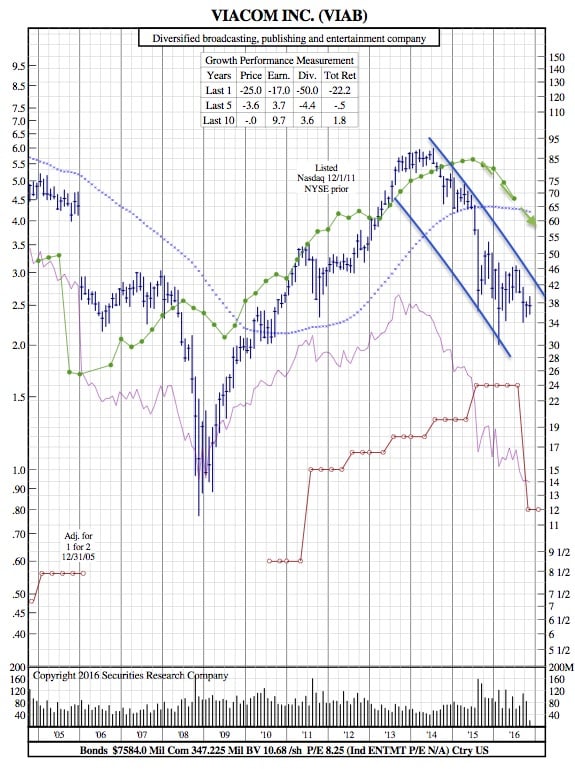

Viacom Posts Less Than Ideal ER to Close Out an Otherwise Disappointing 2016 (12-Year Chart Included)

Zacks– Viacom Inc. VIAB reported better-than-expected earnings in the fourth quarter of fiscal 2016. Adjusted net income from continuing operations in the reported quarter was $273 million, down 56% from $614 million in the prior-year quarter. Adjusted earnings per share of 69 cents beat the Zacks Consensus Estimate of 65 cents but declined 55% year over year.

Total revenue in the quarter was $3,226 million, down 15% year over year. A strong U.S. dollar hurt the top line. Quarterly adjusted operating income of $538 million plunged 49% year over year.

At the end of the fourth quarter and fiscal 2016, Viacom had $379 million of cash & cash equivalents and $11,896 million of outstanding debt compared with $506 million and $12,267 million, respectively, at the end of fiscal 2015.

Segmental Performance

Media Networks

Quarterly revenues for the company’s media networks segment were $2,483 million, down of 11% year over year.

Quarterly operating profits came in at $750 million, down 27% year over year. Revenues were adversely impacted by lower affiliate and advertising revenues, partially offset by an increase in ancillary revenues.

Filmed Entertainment

Quarterly revenues declined 24% year over year to $774 million. This segment saw a decrease in theatrical revenues and an increase in home entertainment revenues. The segment reported a loss in the quarter of $137 million, which compared unfavorably with the prior-year quarter profit of $122 million.

Viacom faces tough competition from peers like Time Warner Inc. TWX, Walt Disney Company DIS and Discovery Communications DISCA.

12-Year Chart:

Today’s earnings beat is welcome news considering the key metrics Viacom has posted after the last year. Viacom’s 1-Year averages are: Price -25%, Earnings -17%, Dividends -50%, & Total Returns have fallen 22%.