Alcoa Sets Less Than Ideal Tone to Earnings Season (25-Year Chart Included)

Alcoa’s stock sank Tuesday after the company reported earnings and revenue that missed expectations.

The company posted earnings excluding items of 32 cents a share on revenue of $5.21 billion for the fiscal third quarter.

Analysts had expected the aluminum company to report earnings of about 35 cents a share on $5.31 billion in revenue, according to a consensus estimate from Thomson Reuters.

Shares of the company dropped 4.7 percent in premarket trading after the news. Earlier, the stock was down more than 7 percent.

“Alcoa steered steady and showed resilience in spite of near-term market challenges,” Chairman and CEO Klaus Kleinfeld said in a statement. “Profits grew in the combined Arconic segments, and Alcoa Corporation segments managed successfully to stay profitable in a low pricing environment. Productivity across the portfolio was exceptional, and paired with non-essential asset sales, further strengthened our cash position.” Kleinfeld told CNBC on Tuesday the company has to admit it is seeing near-term challenges in some markets. “On the aerospace side, we’re seeing that there is huge demand there,” Kleinfeld said on “Squawk on the Street ,” but he adds there are problems on the engine side and others. (CNBC)

The company said revenue was down 6 percent year on year, due to the impact of “curtailed and closed operations, lower alumina pricing” and other pressures. The company, however, reported productivity gains of $377 million year-over-year across all segments.

Alcoa (AA) expects other potential asset sales of approximately $250 million in the fourth quarter. Gross proceeds from company asset sales completed in 2016 are expected to total about $1.2 billion.

The earnings report comes weeks ahead of Alcoa’s plan to separate into two independent publicly traded companies — Arconic and Alcoa Corp. — on Nov. 1. The deal has been approved by its board of directors.

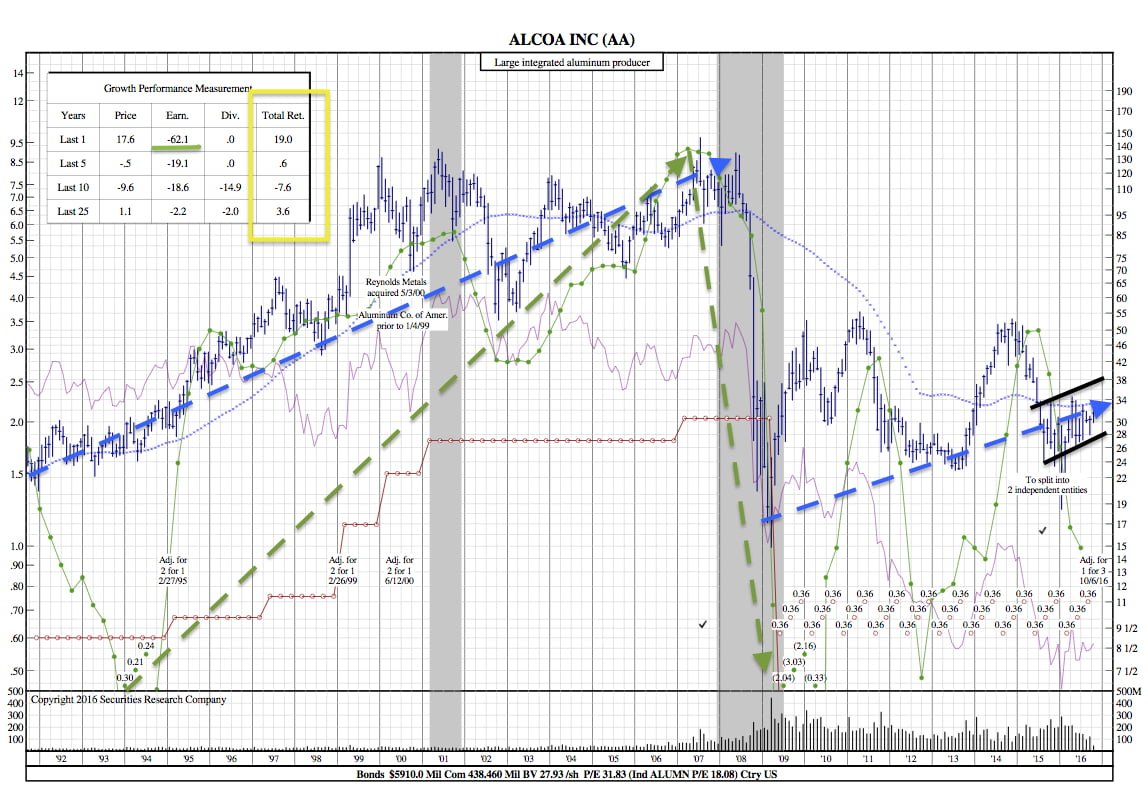

25-Year Chart:

Alcoa’s earnings typically have a strong effect on its stock price. As one can see it the chart, there are remarkable correlations, most notably in ’01, ’08-’09, and a rise in 2014.

As noted in the top left corner, earnings are down over 62% in the last year. So is it time for price to follow suit?