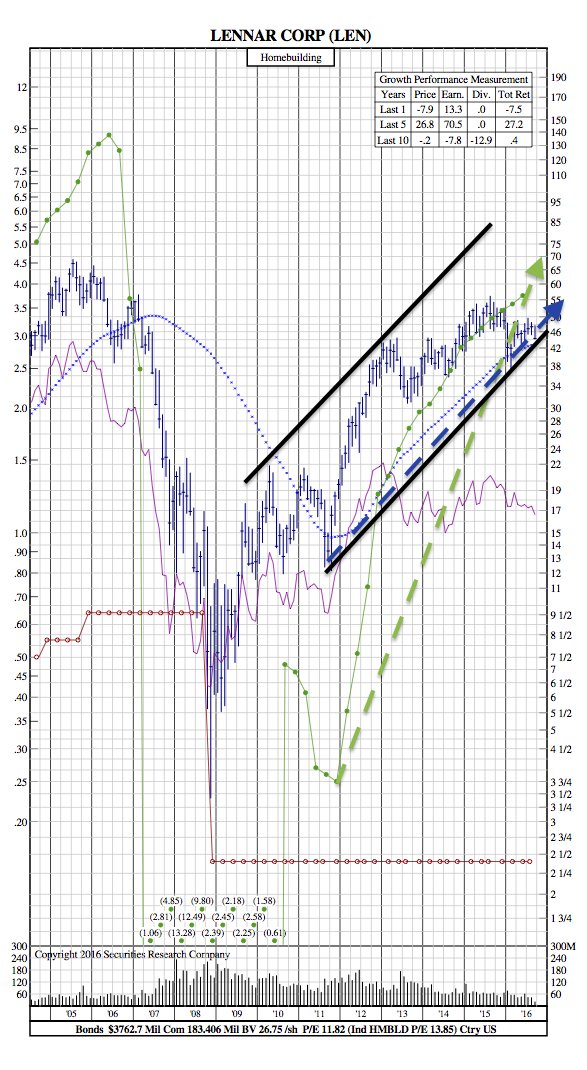

Lennar Q3 Earnings Report and 12-Year Chart

Lennar Corporation ($LEN) is set to report its Q3 earnings on Sep 20, before the market opens. Last quarter, it posted an earnings beat of 9.20%. In fact, the company has recorded positive earnings surprises in all of the past four quarters, with an average surprise of 14.98%.

New home sales were up unexpectedly to an almost nine-year high in July as demand for new homes picked up amid a recovering economy. Lennar expects the backlog conversion ratio to be around 75% in the fiscal third quarter. In the fiscal fourth quarter, the company still expects to achieve a backlog conversion of at least 90%. Given consistently strong demand, we anticipate strong volume trends to continue into the fiscal third quarter. This, along with higher selling prices, should provide ample support to both the top and the bottom line. That said, Lennar needs to watch out for its gross margins, which have been weak for several quarters now due to rising land costs amid moderating home price growth. For the fiscal third quarter, the company expects gross margins to be between 22.5% and 23%. Again, the company has a high debt burden. As of May 31, 2016, Lennar had a total debt of $857.6 million, compared with $792.9 million as of Nov 30, 2015. (Source: Zacks)

Since the article was written:

Lennar’s third quarter fiscal 2016 adjusted earnings were $1.01 per share. Earnings advanced 5.2% from the year-ago profit level of 96 cents a share driven by solid performance in its homebuilding business. Total revenue was $2.833 billion – revenues also grew 13.7% year over year as homebuilding, financial services, Rialto and multi-family segments performed significantly well in the quarter. (Yahoo Finance)